The Polish construction market is increasingly concentrated in top five regions of the country which generate a steep 55% of construction output. The Mazowieckie voivodship alone contributes more than 18% of the market’s value, ahead of Slaskie, Wielkopolskie, Malopolskie and Dolnoslaskie, whose combined shares amount to 37%. A review of more than 1,000 planned projects performed by PMR researchers reveals that the present trend is unlikely to reverse in the coming years. On the contrary, it may even pick up pace.

According to PMR’s latest, nearly 300-page report entitled “Construction sector in Poland 2014 – Regional focus. Development forecasts for 2014-2016”, the construction market will continue to be dominated by infrastructure projects in the forthcoming years as Poland still has a lot to catch up with. Improvement of the technical condition of roads and railway lines is at the top of project lists in all the regions covered by the report.

Most of the planned road building projects will focus on developing better road connections between the major cities, including Warsaw (S2, S7 and S8), Krakow (S7), Wroclaw (S5 and an access road to S3), Gdansk (S7 and, possibly, S6), Poznan (S5) and Lublin (S17). The plan provides for connecting major metropolises leaving out the regional roads.

Traditionally, Mazowsze will see the strongest construction activity in terms of new construction projects, with projects concentrating in Warsaw being the driving force behind the region’s growth. Some major projects in the city will include: the continuation of the work on the development of the city’s bypass and outbound routes, as well as the continuation of the construction of second line of the Warsaw metro and the upgrade of the Rail Baltica line linking Warsaw and Bialystok – the project’s first section alone from Warsaw to Sadowne was priced at PLN 1.2bn (€285m). Significant funds will also be contributed to developing Warsaw’s railway links to Radom and Lodz. In total, these projects will cost more than PLN 3bn (€715m) to complete.

The funding allocated to transport infrastructure development in the other regions will not be that substantial, but they will also receive sufficient funds to be able to implement some spectacular projects. For example, in Lodz the work is underway on the construction of a tunnel and the Lodz Fabryczna railway station, while efforts are also made to further expand the existing facilities.

Regarding the south of Poland, three municipal centres perform quite well. They are, namely, Wroclaw, Katowice and Krakow. In addition, it is more and more often the case that Rzeszow is also numbered among these prosperous cities. The success of this fast-growing city in eastern Poland relies mostly on the construction of the A4 motorway planned to be completed in 2014.

The north of the country will focus the bulk of its efforts on the development of port infrastructure as hydro engineering construction will obtain significantly larger funding in the next EU financial perspective. The Swinoujscie-based LNG terminal is the largest project. Although it is still under construction, the facility will likely be further enlarged in the future. The key project in Gdansk will be the construction of the DCT 2 container terminal – the plans stipulates that the draught at the 600-metre wharf will be 16.5 metres, while the project’s cost will total PLN 1bn (€240m). Besides, there are plans for port wharves in the individual seaside centres to be improved.

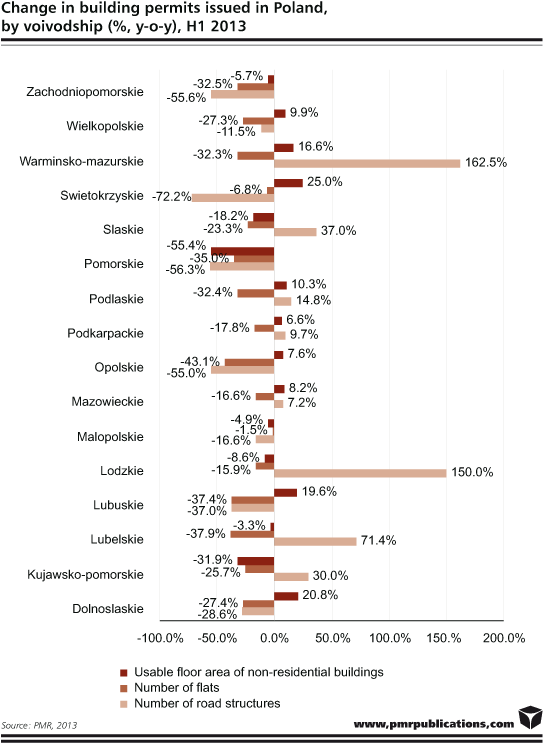

H1 2013 data on construction permits shows that investors in selected regions do significantly better than others based in other voivodships. While the falls in building permits in the residential construction segment are seen across all the regions, the situation in non-residential construction appears to be significantly more stable, which is driven by a greater diversification of building and investor types. In H1 2013, the floor area of the planned non-residential structures dropped by a mere 3% year on year, while the steepest drops in building permits for non-residential construction projects were recorded in Pomorskie, Kujawsko-Pomorskie and Slaskie. On the other hand, the most rapid growth was seen in Swietokrzyskie, Dolnoslaskie, Lubuskie and Warminsko-Mazurskie.

Regarding building permits for road projects, the growth recorded by the top five regions was just average when compared to the rest of the voivodships. The Warminsko-Mazurskie, Lodzkie and Lubelskie voivodships saw sharp growth. Swietokrzyskie, Pomorskie, Zachodniopomorskie and Opolskie, however, suffered significant declines in this respect. These dynamic developments in the road building market in less prominent voivodships are due to a low number of projects planned in these regions. Therefore, even a single project can exert a major impact on the volume of work completed.

Source: PMR

Constructionshows

Constructionshows