Imported construction machinery currently dominates the market in Russia. For many years, Russian producers of building machinery have allocated insignificant amounts for research into, and development of, new kinds of equipment and improvements to the existing product range, mostly because of the limited financial potential. Limited productivity and high running costs have stunted the competitiveness of Russian machinery, not only on the world markets but also at home.

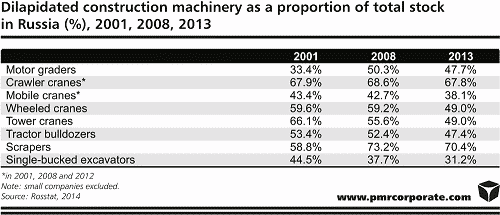

As indicated by the results of PMR’s latest report, entitled “Construction machinery market in Russia 2014. Development forecasts for 2014-2019”, a notable decline in construction machinery stock has been observed since 2000, particularly among large and medium-sized enterprises. The most substantial reduction in the number of units of equipment in use at large and medium-sized companies has been observed with regard to scrapers (-83%) and wheeled cranes (-66%), whereas the numbers of crawler, mobile and tower cranes has been more than halved. The least substantial reduction, still more than 40%, was observed among single-bucket excavators and motor graders.

The reduction in the number of engineering vehicles in use is not a consequence of their redundancy – in fact, demand for construction equipment is rising steadily – but of the fact that rundown equipment is being withdrawn from use and not being replaced by new machinery at a sufficient rate.

Despite the reduction in total stock, excavators continue to be the most widely used category of construction equipment in Russia, as the numbers of units of machinery of other kinds, such as bulldozers and mobile cranes, are also falling. At large and medium-sized companies, in three categories of machinery (excavators, front-end loaders and mobile cranes), less than 40% of total stock can be categorised as dilapidated, whereas with equipment such as front-end loaders, crawler cranes and scrapers the figure is more than 60%. In the case of excavator stock, more than half is accounted for by imported machinery.

In the first half of the last decade the stock of heavy equipment continued to age and wear out, mostly because of the limited financial potential of companies to replace and expand machinery stock. Average wear and tear levels peaked in 2005, and, from 2006 onwards, contractors began to replace their obsolete machinery with new equipment more rapidly. The replacement process was impeded by the crisis in 2009 but was resumed in 2010, when demand for construction services picked up again. In 2013, at large and medium-sized companies the amount of obsolete equipment as a proportion of total building machinery stock in Russia fell to a level not seen since 2000.

The productivity of Russian construction equipment typically falls short of that of its foreign counterparts even when it is second-hand, but some Russian clients still choose Russian machinery for reasons of price, proximity to the manufacturers and a long-term relationship with them, along with simplicity of servicing during and after the warranty period.

Price is, however, no longer such an advantageous facet of Russian machinery, which has become more expensive in recent years. With old and obsolete production facilities, Russian manufacturers are increasingly using Western parts in their machinery. In addition, the cost advantage from lower energy prices has narrowed significantly in recent years, as Russia has been forced to reduce the gap in energy prices as a condition of joining the World Trade Organisation. All of these factors have inevitably led to rises in the prices of the final products. Moreover, the price factor is no longer a competitive advantage for Russian models when these have to compete with Chinese equivalents.

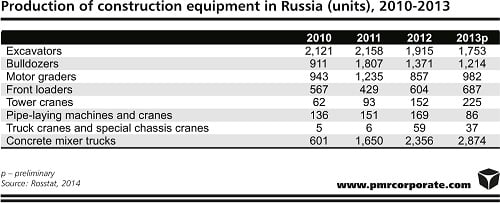

In 2010, in the wake of the 2009 downturn, Russian manufacturers of construction equipment began to recover and to raise production volumes, with growth rates of up to 77% in comparison with 2009 in the case of excavators. Domestic players have not been as active as their foreign competitors and have, therefore, been losing market share, but many of them have succeeded in boosting production by more than ten per cent. In most equipment categories, the 2012 production volumes were still well below the record levels seen in 2007-2008. Last year only the numbers of motor graders and concrete mixers produced were close to the record levels observed before the crisis.

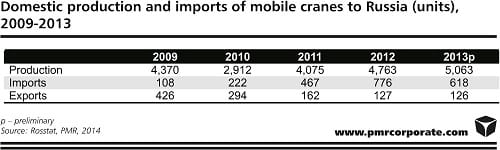

One of the most dynamic subdivisions of the market after the crisis has been that of mobile cranes. Domestic production of such cranes increased by 6.3% in 2013, to 5,063 units. Still, in the early 1990s more than 11,000 mobile cranes were assembled in Russia every year.

According to PMR, in 2013 JSC Autocrane and Galich Mobile Crane Plant (GAKZ) produced 2,065 and 1,297 cranes respectively, after reporting growth rates of 16% and 22%. The third most productive manufacturer of mobile cranes in Russia is the Klintsy Mobile Crane Plant (KAZ), which is estimated to have produced 851 mobile cranes in 2013, 16% short of the performance recorded a year earlier. The three leading producers have been responsible for over 80% of domestic production of mobile cranes over the past two years.

In Russia, demand for mobile cranes is largely met by domestic brands. PMR estimates that 776 mobile cranes were imported in Russia in 2012 and 618 in 2013, accounting for only 16% and 12% of domestic production in the respective years in question. Liebherr cranes dominate imports of mobile cranes with a lifting capacity of at least 90 tonnes, whereas XCMG cranes are the most popular among those with a lower lifting capacity. In terms of exports, it is estimated that 104 new mobile cranes were exported from Russia last year, an increase in comparison with the 86 units delivered abroad in 2012.

Source: PMR

Latest Events News

- Executive Hire Show 2026 delivers business, innovation and record engagement at CBS Arena

- Steve Vick International to make Executive Hire Show debut with Renset power station

- Innovation Trail highlights the kit shaping hire’s next chapter

- Registration Now Open for 2026 National Heavy Equipment Show

- Build Your House Saudi & Inspire for Home KSA Launch in Riyadh — Bringing Qatar’s Premier Home & Lifestyle Exhibitions to the Kingdom

Constructionshows

Constructionshows