Until 2012, the construction industry had been one of the key drivers of the Belarusian economy. Strong growth rates in construction had been largely achieved on the back of state supported infrastructure development programmes. However, this trend has cooled down significantly in the last couple of years.

As indicated by the results of PMR’s latest report, entitled “Construction sector in Belarus 2014 – Development forecasts for 2014-2019”, the Belarusian construction industry contracted by 1.1% year on year in 2013, after a more severe reduction of 8.6% achieved a year before.

In 2013 the industry’s growth performance continued to deteriorate. Among the key factors contributing to the decline in construction activity were:

- poor wider economic growth performance, with the official GDP growth rate falling to 0.9% in 2013 from 1.7% a year earlier

- weak performance in the industrial sector, which recorded a 4.8% decline year on year

- a high base set after 11 years of continuous growth between 2001 and 2011.

In 2013 the construction industry in Belarus was held back solely by the civil engineering construction sector. Many new developments were postponed, which has ultimately delayed the expansion of the country’s still struggling construction industry. The overwhelming share of civil engineering construction output is generated by state-funded construction projects, particularly in the development of the country’s transport infrastructure, as well as by initiatives rolled out by state-controlled companies in the mining and petrochemicals sectors.

Government-targeted programmes aimed at modernising the country’s transport, energy, and social infrastructure has played an important part in the construction industry’s evolution in recent years. In addition, large projects implemented as part of the preparations for the 2014 Ice Hockey World Championship have provided an additional boost to the market. Furthermore, the state’s determination to increase the country’s housing stock has supported a solid upward trend in the residential construction segment, as well as a steady increase in real disposable income, which has boosted retail sales and, ultimately, encouraged construction activity in the retail and service sector.

Looking more closely, new construction is estimated to have recorded a slight decline in 2013, by about 0.5% to BYR 82,364bn (€7bn). The major reason for the 1.1% year-on-year contraction in construction output was the area of extensive renovation and modernisation, which dropped by 10%. The minor repairs segment also saw a significant decline of 6.7%, although the segment was responsible for only 4% of construction output in Belarus last year.

The construction industry is overwhelmingly dependent on funding from the state and local budgets as well as from state-controlled companies, especially in the civil engineering sector. In the last couple of years, Belarus’ financial condition has significantly worsened, which has forced the government to cancel or delay many expensive construction and reconstruction projects, particularly for developing the country’s transport infrastructure networks. According to PMR, the civil engineering construction output tumbled nearly 10%, largely due to weak economic growth and high base effect set up after two years of solid growth rates.

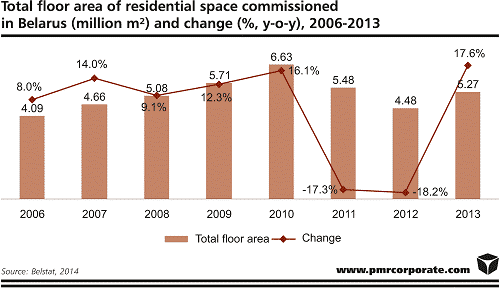

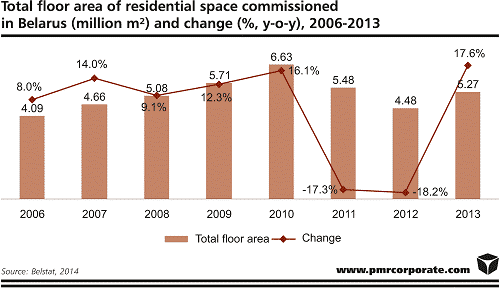

The negative performance in the civil engineering sector was partly compensated by impressive growth witnessed in residential construction. Housing completion resumed an upward trend in Belarus in 2013, after two years of double-digit declines. According to preliminary data, the total floor space of residences put into use in 2013 increased by 17.6% to 5.27 million m² – the third highest result of the past two decades.

PMR estimates that the residential construction output surged by 16.4% in 2013, largely thanks to a low base effect created after a contraction of nearly 30% recorded a year earlier. About 4.6% of housing space activated in Belarus in 2013 was developed with funding from state and local budgets. This share has changed little over the past three years. Another 4.8% of 2013’s supply was developed with residential real-estate developers’ own funds. In addition, 46.9% and 49.2% of housing space activated across the country in 2012 and 2013 respectively was self-funded by individual builders.

In 2013, the number of one-room apartments completed over the year accounted for 26% of new supply, a 28% decline on the previous year. The share of new two-room supply is also estimated to have decreased, by 2 percentage points. Last year, less impressive results in the completion of one and two-room apartments were due to a significant deterioration in the construction activity of real estate developers, which are typically responsible for the construction of such dwellings in Belarus.

Non-residential construction in Belarus is carried out in much lower volumes than is the case with residential construction. After two years of decline, the non-residential construction output is projected to increase by 1.3% in 2014. State activity in the arena of non-residential commercial construction is limited, thus leaving more room for potential investors, including foreign companies. Retail is the most rapidly developing property market in Belarus. In addition, it is an area in which private capital prevails. Despite the fact that most shopping centres are located in the capital, Minsk does not play as dominant a role in this field as it does on the office property market. Taking the construction of new centres into consideration, there were about eight new projects with at least 5,000 m² of GLA activated in 2013 in Minsk. As of early 2014, the city of Minsk included 25 objects each taking up less than 5,000 m², 48 retail schemes of between 5,000 m² and 20,000 m², and only six schemes with at least 20,000 m² of leasable area. Three out of six shopping centres with at least 20,000 m² operating in Minsk were activated last year. Moreover, there are no shopping centres in Belarus with more than 50,000 m² of leasable area.

Source: pmr

Constructionshows

Constructionshows