Unlike construction and earthmoving equipment where the UK remains a net exporter, the UK is a net importer of components and parts. In volume terms (tonnes), the USA is the biggest export destination for components (as it is for equipment), while China and India are the 2 biggest sources for imports. Products included in the UK trade definition for components and parts are buckets and attachments, blades, parts for boring or sinking machinery and other parts for construction equipment. A more detailed definition is at the bottom of the report *.

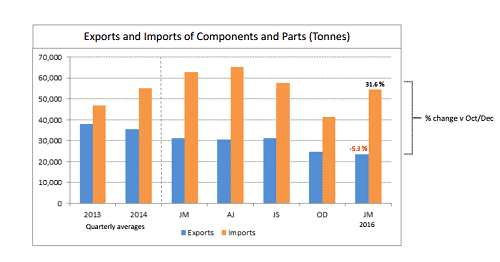

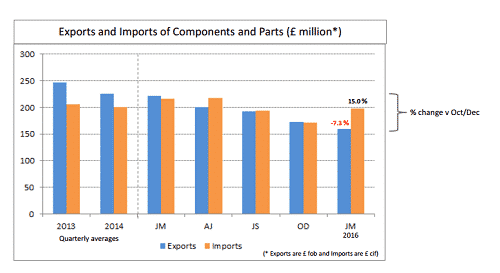

UK exports of components and parts for construction equipment have been on a declining trend since 2013, but unlike exports of equipment, are not stabilising. In Jan/mar 2016, exports were down on Oct/Dec 2015 by 5% in volume terms (tonnes), and 7% in value terms (£ million).

In contrast, imports of components and parts have been on a rising trend since 2013, albeit in 2015, showed signs of slowing, particularly in the second half of the year. However, in Jan/Mar 2016, imports picked up again, increasing by 32% in volume terms (tonnes) compared with Oct/Dec 2015, and 5% in value terms.

As a result of the above, the UK is a net importer of components and parts. This is most significant in volume terms, where for example, in Jan/Mar 2016, import volumes at 54.6 k tonnes were more than double exports at 23.6 k tonnes. In value terms, the gap was less significant, with imports at £198 million (cif) compared with exports at £160 million (fob).

The reason for the smaller gap in value terms is the much higher average value per tonne of exported products compared with imports. In Jan/Mar 2016, the average value of components and parts exported from the UK was £6,800/tonne, not far off double the average value of imported products at £3,600/tonne.

In Jan/Mar 2016, UK manufacturers exported components and parts to over 140 different countries. In volume terms, the top 3 destinations accounted for over 45% of total exports, consisting of the USA (19%), France (17%) and Belgium (11%). The same 3 markets were also the top destinations in 2015.This means that the USA is the top market for UK exports for both equipment and components, albeit the USA has been showing reduced levels in recent quarters, reflecting a cooling down in market demand after a number of years of strong growth.

In Jan/Mar 2016, UK imports of components and parts arrived from 67 different countries. The top 3 importing countries across 2015 and the first quarter of 2016 were China, India and Italy, who between them, accounted for c.63% of total volume, and c.39% of total value in Jan/Mar 2016. China alone accounted for 32% of total volume and 13% of value in Jan/Mar 2016, but import levels from China were down compared with the first 3 quarters of 2015.

In volume terms (tonnes), “other parts” were the highest volume product exported in Jan/Mar 2016 accounting for 68% of total exports. This is followed by blades (14%), parts for boring or sinking machinery (12%) and buckets and attachments (6%).

For imports, “other parts” were also the highest volume product in Jan/Mar 2016 accounting for 88% of total imports, followed by buckets and attachments (8%) and parts for boring or sinking machinery (4%).

*Definition of components and parts included in the analysis of export and import statistics

Trade data has been used from HS (Harmonized System) code 8431: This includes the following:

8431 41 – Buckets, shovels, grabs and grips

8431 42 – Bulldozer or angle dozer blades

8431 43 – Parts for boring or sinking machinery

8431 49 – Other parts for cranes and construction and earthmoving machinery

Latest Events News

- Executive Hire Show 2026 delivers business, innovation and record engagement at CBS Arena

- Steve Vick International to make Executive Hire Show debut with Renset power station

- Innovation Trail highlights the kit shaping hire’s next chapter

- Registration Now Open for 2026 National Heavy Equipment Show

- Build Your House Saudi & Inspire for Home KSA Launch in Riyadh — Bringing Qatar’s Premier Home & Lifestyle Exhibitions to the Kingdom

Constructionshows

Constructionshows