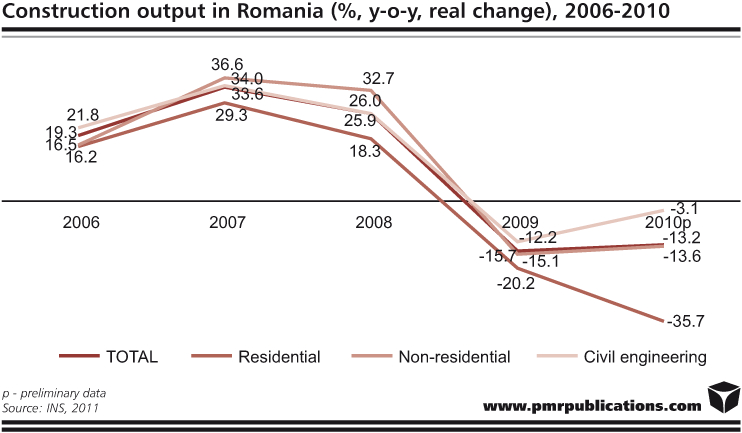

Prior to the start of the crisis, the Romanian construction industry was one of the most vibrant in the European Union, but this changed dramatically in 2009, when construction output fell by 15%, with a similar reduction following in 2010. The current year should finally lead to a measure of stabilisation on the market, but growth is not likely to return before 2012.

Romania was the region’s best performer in construction a few years ago, with output increasing by 20-30% year on year. In both 2009 and 2010, however, 15% reductions were witnessed, mainly because of the outflow of foreign capital and the lack of funding for on-going construction projects and new developments. The steepest reduction last year, of more than one-third in comparison with the preceding year, was seen in residential construction, whereas there was a 3% reduction in civil engineering.

The number of construction companies fell by 9.1% in 2010. In the past two years there have been many bankruptcies, particularly of small companies, because of the dearth of projects and delays in payments for construction work carried out. The number of employees in the industry fell by 8.5% last year in comparison with 2009, to 317,200. However, there was a slight increase in average monthly wages in construction in 2010, to RON 1,580/month (€377).

In 2011, the construction industry has continued to decline. According to the INS, between January and April 2011 there was a 4.7% reduction in comparison with the corresponding period of 2010. A 2.2% increase was observed in non-residential construction between January and April 2011, but there were reductions of 20.8% and 1.8%, respectively, in residential construction and civil engineering.

The non-residential subgroup has, therefore, been the first to recover, and it also accounts for the bulk of the overall market – more than 50%. Civil engineering is expected to follow once infrastructure development projects, particularly those involving road construction, are finally resumed, and residential is expected to be the last to return to growth. The number of residential building permits is still falling.

Construction companies are looking forward to the announcement of new public tenders and the launch of large projects. Substantial amounts of EU funding are available for the development of the country’s infrastructure but it will take time for the Romanian government to gain the necessary expertise to use the money effectively. In the medium-to-long term, Romania remains one of the most promising construction markets in Europe. In anticipation of growing demand in the future, producers of building materials, and of cement in particular, have recently been investing heavily in production capacity upgrade projects.

Growth should return to the overall construction market in 2012, which will be an election year in Romania, and transport infrastructure projects, and motorway construction in particular, are, therefore, expected to receive additional funding.

This press release is based on information contained in the latest PMR report entitled “Construction sector in Romania 2011 – Development forecasts for 2011-2013”.

Source: PMR News Room

Latest Events News

- Executive Hire Show 2026 delivers business, innovation and record engagement at CBS Arena

- Steve Vick International to make Executive Hire Show debut with Renset power station

- Innovation Trail highlights the kit shaping hire’s next chapter

- Registration Now Open for 2026 National Heavy Equipment Show

- Build Your House Saudi & Inspire for Home KSA Launch in Riyadh — Bringing Qatar’s Premier Home & Lifestyle Exhibitions to the Kingdom

Constructionshows

Constructionshows