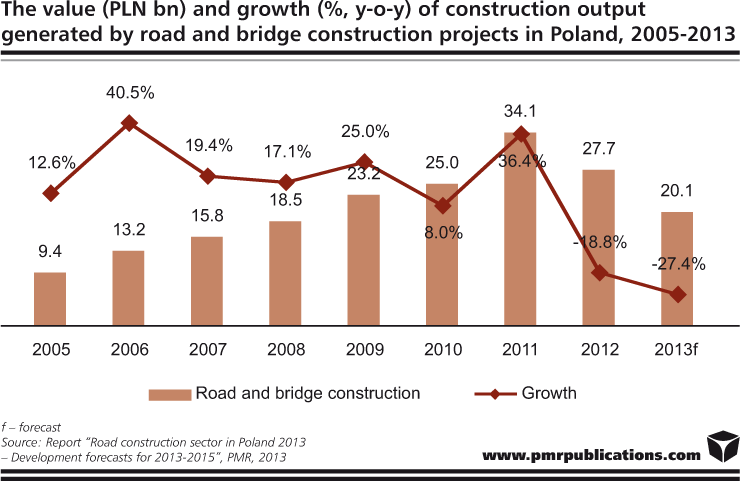

The contribution of road construction to total construction output has consistently grown since Poland joined the European Union, peaking at 28% in 2011. The growth decelerated in 2012 when the sector’s share fell to 22%. The coming two years are likely to be very challenging years for the sector, but the long-term growth potential remains robust, primarily driven by the significant deficiencies in the Polish road system, which is still far from complete.

After a decline recorded in 2012 when the road construction market’s output shrank by some 19%, 2013 is again expected to see a decrease and an output of around PLN 20bn (€4.8bn), according to the latest PMR report entitled “Road construction sector in Poland 2013 – Development forecasts for 2013-2015”. The slowdown in road construction is accompanied by a significant deterioration in the financial standing of contractors due to a smaller number of tenders for new projects.

Polish road construction has reached a turning point, and the final scenario will depend on several factors. Further development of the sector might be stimulated by the planned improvement to the standards of cooperation between principals and contractors. Disputes between contractual parties frequently led to the termination of contracts and delayed numerous projects. Furthermore, when tenders are re-invited, additional costs and delays are incurred.

The latest market practices compliant with the effective laws and regulations were a contributing factor in a wave of bankruptcies. Around 300 construction companies went to the wall in 2012. Some of the key reasons for the rise in insolvencies included low price bids proposed by construction companies and the fact that prices could not be adjusted in subsequent stages. The new rules for tender processes, which are currently in the making, will start to be applied when projects financed under the next financial perspective enter the implementation phase. The future legal framework will aim for a more balanced allocation of risk between contractual parties. Also, adverse effects of significant price changes, which were a source of serious trouble experienced by many companies, are expected to be mitigated (if not completely avoided) through a price adjustment mechanism. Regulations applicable to subcontractors are currently being developed as well. Therefore, there is a good chance that grey economy in the construction industry will be significantly reduced.

It is also important that companies gain an understanding of how to conduct business from painful lessons learned the hard way. If sufficient efforts are made in the next few years, the quality of road work will improve greatly.

A key issue, which forms a basis for future developments within the sector, is to secure funds for the planned projects. PMR’s analysts estimate that projects worth around PLN 85bn (€20bn) are currently in various stages of preparation. Certainly, not all of them will be executed and the final shape of the investment programme planned by the General Directorate of National Roads and Motorways (GDDKiA) will depend on what is agreed during the EU summit. The preliminary EU budget for 2014-2020 sets funding for Poland at roughly the same level as the previous budget; based on this, the civil engineering construction sector will be able to recover its growth potential over the next few years.

Confidence of road building companies is boosted by the fact that GDDKiA intends to announce tenders funded from the new financial perspective already in 2013. In addition, a reasonable timing will help avoid a backlog of tenders and dramatic price fluctuations as those seen when the package of investment projects related to Euro 2012 was implemented.

A very good solution is to hand over road maintenance to private companies under agreements concluded for a specified term. Although the segment is too small to fill the gap resulting of the completion of multi-million construction tenders, it could be an additional market for building contractors. Besides, it generates savings to investors and guarantees the right condition of roads. The agreements currently in place cover around 830 km of national roads. Ultimately, all roads managed by GDDKiA will be maintained by private companies.

Source: PMR

Tags News

Constructionshows

Constructionshows