Investment projects planned by the major power enterprises in Poland provide for the development of units with a combined capacity of 30,000 MW. However, up to 50% of the projects stand a chance of being implemented. In terms of value, nuclear power units are at the helm, overtaking coal-fired units, which are losing popularity, and gas units that are rising to power. Within the renewable energy segment, biomass-fired units have gained popularity significantly, while prospects for the growth of wind farms have deteriorated.

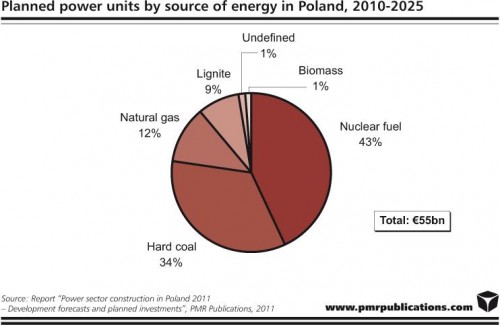

As stated in the research company PMR’s report entitled “Power sector construction in Poland 2011 – Development forecasts and planned investments”, investments in new power generating will deliver nearly 30,000 MW of capacity, while their value is estimated to be around PLN 220bn (€55bn) units until 2025. However, not all the planned projects will be implemented as it is a common practice for investors to make preparations for a larger number of projects and execute only those which are the most profitable under the given economic circumstances.

Nuclear power projects represent the bulk of planned projects as they account for over 40% of the capital expenditure planned. One-third of the planned projects are hard-coal-fired units, which however gradually lose market share to gas units, which currently account for about 12% of the value of projects planned. This trend is a direct result of vague solutions in the area of carbon dioxide emissions rights and of the improvement in long-term prospects for gas supplies to Poland.

The last 12 months brought a number of significant events for the power engineering industry, including in particular steady progress in the preparations for the construction of several power generating units (including Opole, Turow, Ostroleka, Stalowa Wola, Jaworzno, Kozienice, Pelplin and Rybnik), continued growth of the renewable energy sector (in particular wind and biomass projects), suspension of major investment projects planned by CEZ (Skawina), RWE (Wola) and Vattenfall and the long-drawn-out changes in the shareholder structure of power groups, which can lead to postponement of some of the planned projects until the shareholder structure is clarified.

According to the report’s authors, within the renewable energy sector, growth prospects for the wind energy sector have been seriously realigned as, earlier, many investors’ interest had been partly based on speculations, but that was curbed. In connection with the 2010 amendment to the Energy Law, Enea Operator and Energa Operator cancelled most applications for terms and conditions for connecting new wind farms. Additionally, reduced subsidies to ‘green’ energy will result in wind farms’ investors losing part of subsidies and ‘green’ certificates. Investors were seen to suspend new wind energy projects already at the end of 2010 in the wake of the legal changes. Moreover, according to PSE Operator, Poland is capable of accepting up to 6,000 MW of energy into its power system in 2020, which is much below the wind energy industry’s expectations.

On the other hand, the use of biomass in combustion and co-combustion (with coal) processes to produce ‘green’ electricity and heat is enjoying growing popularity. Biomass has become a strong component of investment plans adopted by large power groups (such as Tauron, GDF SUEZ and Dalkia Polska) and small local CHP plants alike. Thus, next to wind energy, biomass is steadily coming to the foreground in Poland meeting the EU objectives for renewable energy.

This press release is based on information contained in the latest PMR report entitled „Power sector construction in Poland 2011 – Development forecasts and planned investments”.

More info: www.pmrcorporate.com

Tags Industry News News

Constructionshows

Constructionshows