Outlook improves as region adjusts to new reality

New construction market report from MEED

Construction outlook improving despite spending cuts

- Latest MEED research shows construction outlook improving

- Private sector investment will be a key driver of new construction opportunities in 2017

- Private investment will be vital to easing pressure on government finances

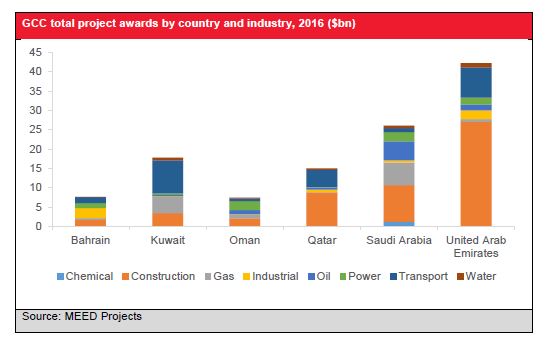

- 2016 saw 33 per cent fall in project contract awards in the GCC

- Dubai, Kuwait and Bahrain were GCC’s strongest construction markets in 2016

- Government spending cuts saw a 62 per cent fall in awards in Saudi Arabia in 2016

- Implementing reform programme will be Saudi Arabia’s driver for coming three years

Dubai, 30 April 2017: The outlook for construction companies in the GCC will improve in 2017, according to the latest industry research report from Middle East business intelligence service MEED.

In Outlook for GCC Construction 2017, MEED reports that the region still offers significant opportunities for construction companies despite the slowdown in project spending.

But the report warns however that a fall in the volume of new opportunities coupled with increased uncertainty about project timelines will see the construction marketing further hardening in response to increased competition.

Outlook for GCC Construction 2017 says that the region’s strongest markets over the past 12 months were Dubai, Kuwait and Bahrain, which saw its second-best year for awards since 2007, thanks to the financial support of its GCC partners through the Gulf Development Fund.

The approval of the main contract award on the expansion of Kuwait airport took that market to an all-time high of $12.2bn of project contract awards in 2016, while the start of work towards Expo 2020 in Dubai enabled the UAE also to record an increase in awards in 2016.

Dubai recorded the lion’s share of the project activity in the UAE in 2016, accounting for 72 per cent of all construction and transport deals in the country, while project spending fell sharply in Abu Dhabi.

Elsewhere in the region however, the fall in oil prices since mid-2014 has had a profound impact on the construction market in the GCC.

With government revenues halved, ministries and other client bodies have had strict limitations imposed on capital spending. This has resulted in projects delays and payment areas, while construction and transport contract awards have dropped in the GCC for the past three years.

The worst performing countries were Saudi Arabia, which saw a 62 per cent drop in contract awards, followed by Qatar and Oman. Delays in payments from government clients were a huge problem in Saudi Arabia, Oman and the UAE, affecting the cash flow of contractors and forcing thousands of layoffs.

Outlook for GCC Construction 2017 concludes that while the regional construction market will continue to be challenging in 2017 due to continued uncertainty surrounding government spending, the outlook is brightening.

The recovery in oil prices in 2016 has eased some of the pressure on government finances, while the increased pace in the roll out of economic reforms will see an improvement in confidence as well as an increase in new forms of project model, such as public private partnerships (PPP).

All GCC governments want to increase private sector investment to ease the burden of capital spending on the treasury and this will create new opportunities in the year ahead.

Governments have been taking important steps to develop new revenue streams as well as tapping debt markets, which will help clear up payment arrears.

Saudi Arabia says it plans to double infrastructure and transport spending this year. Its Vision 2030 programme provides a long-term vision for economic development while the National Transformation Programme has set economic strategy up to 2020 and the coming three years will be all about implementation. But, according to the Outlook for GCC Construction 2017. The kingdom must first establish project management offices, which could delay any recovery.

Outlook for GCC Construction 2017 warns however that considerable risks remain.

Capital spending will remain constrained and the success of PPP has been limited in the past, so there will be many new challenges to address.

“There is no doubt that the worst is behind us for the region’s construction market,” says MEED editorial director Richard Thompson. “The sharp cuts to spending in 2015 and 2016 across the region, but particularly in Saudi Arabia, Qatar and Abu Dhabi has been very painful for the GCC construction industry. But the recovery in oil prices and the implementation of reforms means that we will see things improving throughout 2017.”

“Contractors should still be prepared for a challenging year however,” says Thompson. “The reform programme will take time to kick in and while we can expect to see key projects moving forward this years, there is still considerable uncertainty about delivery timelines.”

Constructionshows

Constructionshows