A number of construction projects in the civil engineering sector in the Czech Republic were launched in 2013 and this is expected to bare fruit in construction output from 2014 onwards. Much of the growth in the coming years is to come from the railway construction sector, which has seen an increase in funding with a number of major construction projects already up and running.

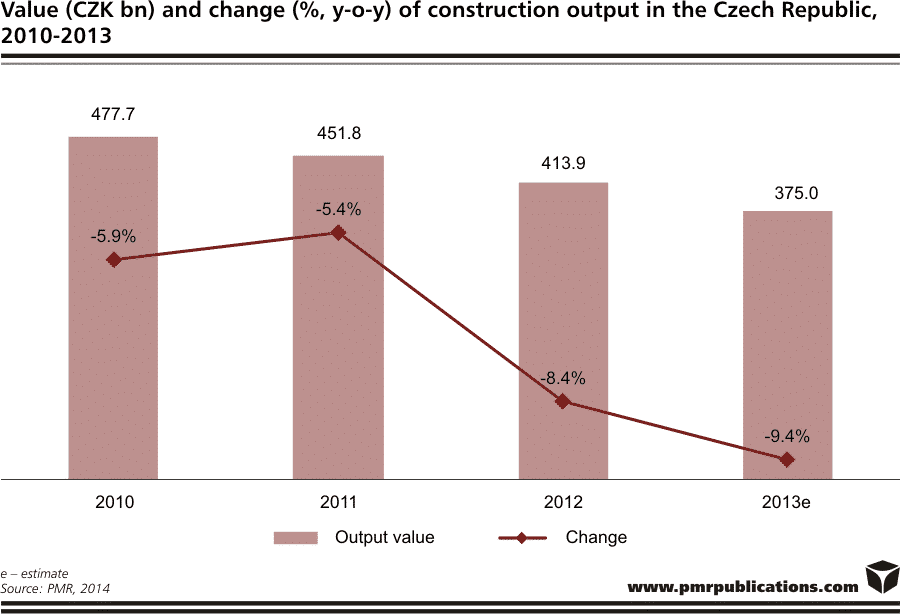

According to a new report entitled “Construction sector in the Czech Republic 2014 – Development forecasts for 2014-2019” published by the analytical and research company PMR, following another year of decline, the Czech construction industry is expected to stabilise in 2014 before seeing the first signs of recovery in 2015. The report points to an insufficient number of orders in the public sector and a low appetite for investment by private developers as the main reasons for the sector’s very slow recovery.

PMR’s report also highlights major factors that are to have a favourable bearing on market forecasts, these include: reinvigorated plans for railway construction, low interest rates, which will help residential construction, a surging demand for office and industrial facilities, and increasing business confidence in the sector.

It also considers the causes of an adverse effect on forecasts such as a price war, which is affecting the quality of construction work, the relatively high levels of investor restraint, and the disputes and wrangling over orders which are continuing to delay the much needed new investment.

EU funding for transport infrastructure construction has been secured, and demand for residential space is on the rise. Added to a recovery in demand for office and industrial space, the Czech construction industry is well set to kick start a period of stable growth from 2015.

Transport infrastructure construction is expected to see improvements in the coming years. Especially after the government came up with a series of proposals and strategic plans in 2013 that will impact on this sector in the years to come. In November 2013, the government approved a nationwide strategy for the construction of roads, rail, and water infrastructure by 2020. The strategy is laid out in a major document to be used to attract the necessary EU funding and foresees an annual spend of at least €2.6bn by 2020 on transport infrastructure construction.

Looking as far ahead as 2023, the biggest investments in this sector are the repair of the D1 motorway between Mirocovice and Kyvalka (a project worth €600m), the construction of the Prague bypass road: Bechovice-motorway D1 (€460m), and the construction of the R35 expressway section: Opatovice-Ostrov (€430m). Moreover, the Czech government is looking at the public-private partnership (PPP) model for the construction of the country’s motorways and expressways.

In the Czech railway sector, construction activity started to pick up in 2013 after a relatively weak 2012. A total of 15 major rail construction projects were completed in 2013 with one of the largest being the Votice-Benesov rail section at a cost of CZK 8bn (€300m).

A number of other projects were given the green light in the summer of 2013 and it is hoped that some €700m − more than 20% up on 2013 − is to go into rail infrastructure construction in 2014.

The biggest investments set to be made in the coming years centre on Brno, where the city is to get a new railway station, as well as a rail overhaul for the whole area costing €800m. A further €960m is to be spent modernising the line between Brno and Prerov.

Tags News

Constructionshows

Constructionshows