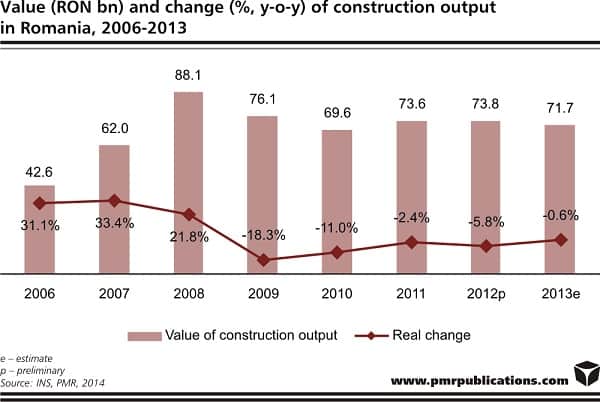

After the double-digit declines in construction output seen in 2009 and 2010, which in turn created a very low base for comparison and therefore a seemingly guaranteed positive figure in 2011, the construction industry in Romania maintained its downward trend not only in 2011, but, according to PMR, in the following two years, too: down 5.8% in 2012 and a further 0.6% last year.

As indicated by the results of PMR’s latest report, entitled “Construction sector in Romania 2014. Development forecasts for 2014-2019”, the construction industry in Romania struggled in 2013, contracting year on year by 0.6%, after an estimated 5.8% decline recorded in 2012. Last year, a drop in total construction output was due entirely to the weak performance of the non-residential construction segment, which fell year on year by 7.5%. Still, the slump in non-residential construction activity was counterbalanced by a 5.4% increase in residential construction output and a modest 1.4% increase in the civil engineering construction segment.

When analysing 2013’s growth performance by manner of implementation, the only type of work that dragged down construction output was new construction. According to preliminary data, new construction output tumbled 9.4% last year, particularly due to the very modest contribution from the public sector which prioritised repair and modernisation projects. In 2013, spending on extensive repair construction projects shot up by 27.5%. In addition, maintenance and current repairs output surged 12.7%.

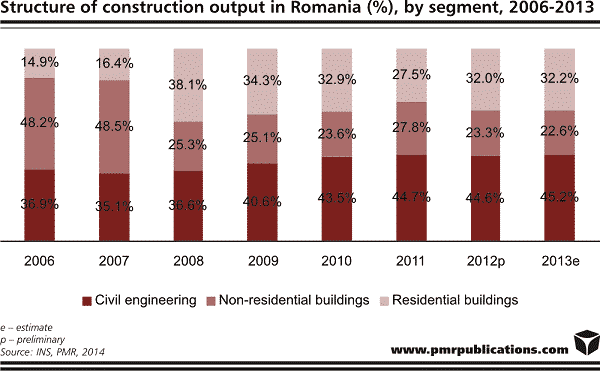

Civil engineering is the leading segment in Romania’s construction industry. However, over the last couple of years the civil engineering sector in Romania struggled. PMR believes that the sector fell by 5.9% in real terms in 2012, after the flat growth seen a year earlier. According to preliminary data revealed by the INS, civil engineering construction output resumed growth in 2013, expanding by 1.4%. The upward trend has been largely supported by transport infrastructure construction projects implemented with financial support from the EU. In recent years, more than 60% of annual spending on road projects has been channelled towards the development of the country’s national road network, even though these roads take up just 20% of Romania’s total public road network and includes motorways and E-roads. The network is administered by CNADNR (National Company of Motorways and National Roads in Romania). In 2013, the company allocated about RON 3.8bn (€851m) to the development of the country’s motorway network. During the year 116 km of motorways were activated in Romania.

It should be mentioned that within the Cohesion Fund 2007-2013 scheme, for Romania was allocated nearly €4.3bn to be spent on transport infrastructure, of which €2bn was to be consumed on the development of the country’s national road network included in Pan-European transport corridors. However, during 2007-2013 Romania was able to absorb only 35.6% of the €2bn allocation for road projects. Still, the 2007-2013 budget has until the end of 2015 to be absorbed. CNADNR announced that contractors could complete almost 93 km of motorway this year and has also revealed ambitious projections for 2015, when the company predicts about another 195 km of motorways will be completed.

According to preliminary data provided by the National Institute of Statistics, non-residential construction output fell by 7.5% last year. This weak performance came after a more dramatic setback in 2012 when PMR estimates that the segment plummeted 20%. The non-residential segment’s modest activity has been generated mostly by a lower contribution from the public sector in the last couple of years and the weak economic environment in the EU area which has not encouraged developers to accelerate activity in the hotel and office construction segments. Last year investors secured the lowest number of non-residential construction permits in more than a decade. In 2008, the sector was responsible for 25.3% of the total construction output in Romania. In recent years, its share has decreased gradually and, according to PMR, is estimated to have been 21.8% in 2013. Administrative buildings continue to be the largest category within the non-residential segment, with an estimated share of 40% in 2013, slightly higher than the 39.7% a year earlier. Industrial buildings are the second largest category, with a share of nearly 27% in 2013, followed by retail and wholesale buildings, which accounted for around 11% last year.

The residential construction segment was the best performing segment of the construction industry in Romania in 2013. According to the National Institute of Statistics, the segment increased in real terms by 5.4% y-o-y last year. However, preliminary data reveals that the number of completed homes continued to decrease in 2013 by 9.0% reaching 40,071, after a 3.1% decline recorded a year earlier. This figure brought the market down to pre-2007 levels.

The total number of construction permits issued for residential buildings in Romania continued to fall in 2013, though by only by 0.3% y-o-y reaching 37,918 – the lowest level since 2004. Nevertheless, not the same trend is observed when analysing the permit situation by area. The figure for 2013 was 6.9 million m², 3.5% more than in 2012 and just 45.5% of the area registered in 2008. The downward trend in the total useful area of residential property for which construction permits were issued likely bottomed out in 2013, and is expected to maintain upwards momentum in the coming years, supported by the low base effect and ongoing economic recovery

Source: PMR

Tags Construction News

Constructionshows

Constructionshows