In 2012 the construction industry managed to remain basically flat in real terms (just 0.2% decline). During the first half of 2012, the Romanian construction industry showed great promise, with recovery fuelled by the unusually warm winter, some encouraging corporate results from Q4 2011 and Q1 2012, and the improving business sentiment among developers.

However, the market moved into the red in the second half of the year, being significantly distressed by renewed concerns over the debt crisis in Europe. Another factor which dragged the market down in 2012 was the country’s political upheavals, which saw a referendum to suspend the president, three different Prime Ministers, and parliamentary elections held at the end of the year.

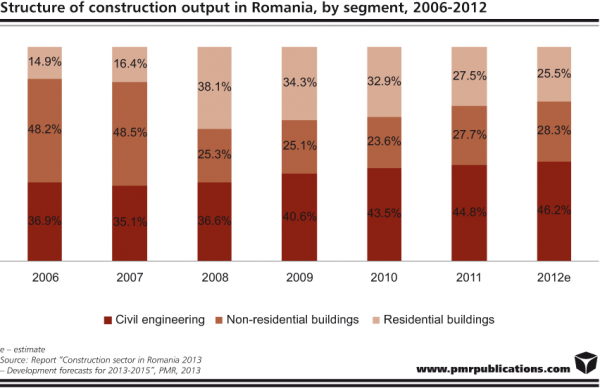

An analysis of construction output broken down by building type shows civil engineering construction to have strengthened its leading market position over the past four years. In 2012 the market continued to be fuelled mainly by state investment, mostly related to the development of the country’s transport infrastructure. At the same time, non-residential and residential real estate developers have not been able to keep pace with the civil engineering segment, partly due to the difficult fund-raising environment and an on-going reluctance to invest in residential properties.

Civil engineering construction registered a better performance in 2012 compared to the other two construction segments. The reason behind this is the continuous investment in infrastructure projects with financial support from EU and state funding. According to preliminary data presented by the National Institute of Statistics, in 2012 civil engineering construction output expanded year-on-year in real terms by 2.9%. The segment was largely driven by road projects, as well as sky-rocketing investments in renewables. Last year, 286 km of national road was renovated and 140.2 km of motorway, which in case of motorway construction represented the best annual performance in 20 years, was put into use across the country. Despite the fact that in 2012 the National Company of Motorways and National Roads (CNADNR) did not conclude any contracts for new motorway sections, a year earlier it signed nine contracts worth almost €1.3bn which envisage the construction of 180 km of motorway to be completed in 2013. Overall, CNADNR has current contracts for almost 230 km of motorway to be put into use across the country in 2013, however, completion levels at the moment suggest that only about 142 km actually be completed this year.

A strong double-digit increase has been seen in the railway construction segment. The decisive support for this performance came from the first contracts for the modernisation of individual segments of the Pan-European Corridor IV railway line, which were awarded in late 2011. An impressive uplift was also witnessed in the construction of energy generation facilities. Thanks to amendments to the support scheme for renewable energy projects approved in November 2011, investment in this segment sky-rocketed last year. At the end of 2012, Romania’s combined power generating capacity in wind turbines, solar energy projects, and biomass plants, reached about 2,000 GW, expanding twofold over the year.

The non-residential construction market increased in real terms by 2.1% y-o-y. That still modest activity is explained by a lack of private investment in new construction, mainly as a result of the difficult fund-raising environment and weak economic recovery which kept vacancy rates in this sector at high levels. In 2012, the best performing segment within non-residential construction was retail and services construction, where developers are more active in launching projects, although not as many as in previous years. In 2012 investors secured the lowest number of non-residential construction permits in ten years. Administrative buildings continue to be the largest category within the non-residential segment, with an estimated share of 40% in 2012. Industrial buildings are the second largest category, with a share of 25% in 2012, followed by retail and wholesale buildings, which accounted for 13% in 2012.

The residential construction segment was the worst performing segment of the construction industry in Romania in 2012. According to the National Institute of Statistics, the segment contracted in real terms by 15.4% y-o-y last year. Preliminary data reveals that the number of completed homes continued to decrease in 2012 by 6.3% reaching 42,566, after a 7.0% decline recorded a year earlier. This figure brought the market down to pre-2007 levels. The total number of construction permits issued for residential buildings in Romania continued to decrease in 2012 by 3.9% from 2011, reaching 38,025, which is the lowest level since 2004. The same trend is observed when analysing the area of residential buildings for which construction permits were issued. The figure for 2012 was 6.8 million m², 2.0% less than in 2011 and only 44% of the area registered in 2008.

Source: PMR

Tags News

Constructionshows

Constructionshows