Over the last decade, construction machinery stock owned by construction companies in Russia has been depleted by 40-60% on average, and the equipment still in use is largely dilapidated and obsolete. It is not suitable when modern road construction and maintenance techniques are to be used. In view of the extensive infrastructure investment planned, demand for earthmoving, road building and other equipment is likely to grow considerably over the next ten years.

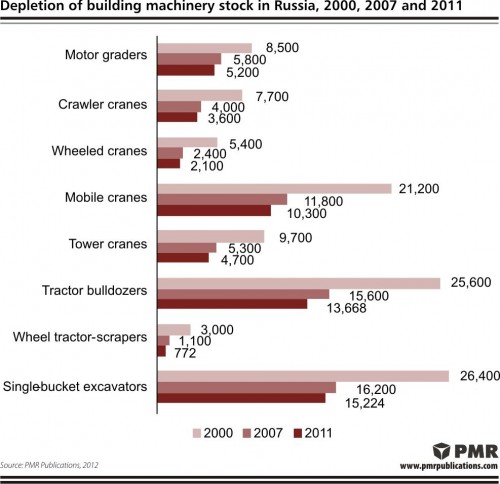

Since 2000, a significant depletion in construction machinery stock has been observed. The most substantial reduction in the number of units of equipment in use has been observed in wheel tractor-scrapers (-75%) and wheeled cranes (-61%), whereas the numbers of crawler, mobile and tower cranes have been more than halved. The least substantial depletion, still a significant 40%, was observed among single-bucket excavators and motor graders.

The reduction in the number of engineering vehicles in use is not a consequence of their redundancy – in fact, demand for construction equipment is rising sharply – but of the fact that rundown equipment is being withdrawn from use and not being replaced by new machinery at a sufficient rate.

In the first half of the last decade heavy equipment stock continued to age and wear out, with few companies eager to buy new machinery. Average wear and tear levels peaked in 2005 and, from 2006 onwards, during the construction industry boom, contractors began to replace their obsolete machinery with new equipment. On average, dilapidated construction machinery still accounts for more than 50% of total equipment stock in Russia. In categories such as excavators, bulldozers and mobile cranes, less than half of total stock can be categorised as dilapidated, whereas with equipment such as graders and scrapers the figure is more than 60%.

Extensive road construction is expected in Russia. A number of projects, including the implementation of development programmes prepared by the government which promote the use of the vast natural resources in the eastern regions of the country, the maintenance and repair of roads, the development of a network of new roads, the construction of high-quality federal highways and the reconstruction of existing roads which form international transport corridors in the European part of Russia, whether North-to-South, Centre-to-Urals, or in directions which ensure the use of the economic potential of the Far East and Siberia all require urgent measures which will encourage the production of construction and road building machinery.

In addition, substantial outlays are planned for the creation of a network of toll roads in Russia, the modernisation of the energy industry, the development of greater Moscow, including the construction of roads and other infrastructure, the development of infrastructure in the Northern Caucasus, the creation of the Russian „Silicon Valley” in Skolkovo, and the construction of numerous oil and gas pipelines.

All of these projects will drive demand for all kinds of earthmoving, road building and other equipment for many years, even if government programmes are not implemented in full, which is very likely. The Russian construction equipment market, given the poor average condition of machinery currently in use by Russian builders, boasts many opportunities, for foreign producers in particular. This is due to the fact that the production capacity of the Russian machine building industry will not be able to satisfy the demand which will result from the extensive construction work planned, either in terms of quantity or the quality of equipment and the product range.

This press release is based on information contained in the latest PMR report entitled “Construction machinery market in Russia 2012 – Development forecasts for 2012-2014”.

Tags News

Constructionshows

Constructionshows