AEM Provides Market Update and Analysis

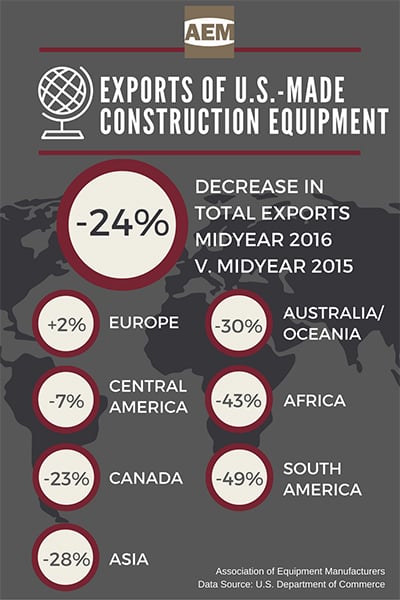

MILWAUKEE (August 31, 2016) – Exports of U.S.-made construction equipment were down 24 percent overall at midyear 2016 compared to the first half of 2015 with a total $5.65 billion shipped to global markets.

Europe was the sole region with a gain – up 2 percent, and South America and Africa led the double-digit declines, according to the Association of Equipment Manufacturers (AEM), citing U.S. Department of Commerce data it uses in global market reports for members.

AEM is the North American-based international business group representing the off-road equipment manufacturing industry.

Exports by World Region

January-June 2016 U.S. construction equipment exports by major world regions compared to January-June 2015:

- Canada dropped 23 percent, for a total $2.4 billion

- Europe gained 2 percent, for a total $898 million

- Central America fell 7 percent, for a total $696 million

- Asia decreased 28 percent, for a total $664 million

- South America declined 49 percent, for a total $504 million

- Australia/Oceania fell 30 percent to $294 million

- Africa declined 43 percent to $220 million

AEM Market Overview

“For the past 14 quarters, U.S. exports of construction equipment have declined year over year and at the midpoint in 2016, that trend remains unchanged,” said AEM’s Benjamin Duyck, director of market intelligence.

“With the global economic malaise, the slowdown in emerging markets and the negative interest rates in several economies’ bond markets, investment is flowing to the U.S. and U.S. stocks, driving up demand for the U.S. dollar, inadvertently affecting our competitiveness abroad.”

Exports by Top 10 Countries

The top countries buying the most U.S.-made construction machinery during the first half of 2016 (by dollar volume) were:

Canada – $2.4 billion, down 23 percent

Mexico – $561 million, down 7 percent

Australia – $273 million, down 29 percent

Belgium – $204 million, up 39 percent

Germany – $148 million, up 32 percent

Peru – $133 million, down 31 percent

China – $122 million, down 13 percent

Japan – $109 million, up 24 percent

Chile – $108 million, down 60 percent

United Kingdom – $100 million, down 7 percent

Economic Resources Available

AEM provides a variety of market macroeconomic and industry trend data for members as well as survey opportunities and custom research. Visit www.aem.org in the Market Data/Market Intelligence section. For more information, contact AEM’s Benjamin Duyck, director of market intelligence ([email protected]).

Constructionshows

Constructionshows