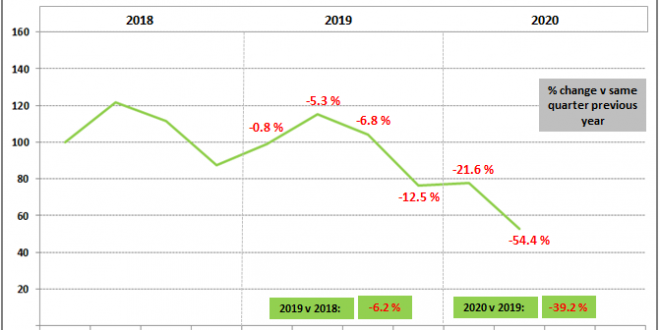

Retail sales of construction and earthmoving equipment in the UK market fell by 39% in the first six months of the year compared with the same period in 2019. Sales in the second quarter fell by 54%, reflecting the worst of the COVID crisis, after showing a 22% decline in Q1, compared with 2019. This is illustrated in the first graph below showing quarterly sales on an index basis from the construction equipment statistics exchange*, using Q1 2018 as 100.

The monthly pattern of sales in the second quarter of the year presents a more positive story. The decline in sales in June was 36% below 2019 levels, after following more significant falls of 74% in April and 54% in May. This clearly suggests now that the low point in new equipment sales due to the pandemic was reached in April, with sales just below 800 units. Recovery was underway in June, with sales reaching just over 2,000 units, as the return to work within the construction industry continues.

The second chart below shows a ranking of sales for the major equipment types, showing the size of the decline in the first half of the year compared with the same period in 2019. This shows that the most popular equipment type, mini and midi excavators (up to 10 tonnes), has seen the strongest demand in the first six months of the year. Sales for this product were down by 23% in the first half of the year, which is less than half of the fall experienced by all of the other equipment types. Other equipment types experienced falls of 50% or more in sales, with telehandlers (for construction only) and compaction rollers seeing the biggest declines of over 60% compared with 2019.

A map of the UK below shows percentage changes in regional sales in the first six months of 2020 compared with the same period in 2019. This shows that sales of equipment have been most resilient in Wales and the West Midlands, where sales have been down by only 19% and 26% respectively, compared with 2019 levels. Other areas where sales have been better than the average national decline are the North West, Yorkshire, Northern Ireland and London. Weakest sales have been in the South East (excluding London), where sales are down by over 50% compared with last year.

The construction equipment statistics exchange also covers retail sales of equipment in the Republic of Ireland. This shows a 30% decline in sales in the first half of 2020, compared with 2019. Sales in Q1 were only 8% down on last years’ levels, but then fell by 51% in Q2.

* The construction equipment statistics exchange is run by Systematics International Ltd. This scheme is run in partnership with the Construction Equipment Association (CEA), the UK trade association.

Source: Construction Equipment Association (CEA) News

Constructionshows

Constructionshows