The market of industrial construction (comprising industrial and warehouse buildings, transmission lines and industrial complexes) hit a record high of over PLN 20bn (€4.8bn) in 2013. Moreover, construction and assembly output generated by the segment will continue to improve in the short term.

A clearly positive indication for growth is the launch of the construction of power units at the Opole power plant. This project alone will generate an output of around PLN 2bn (€480m) a year in 2014-2015. There are also other major projects that will get underway, e.g. the construction of a power generation unit at the Jaworzno facility, which may potentially generate an annual output of PLN 1bn (€240m) in four consecutive years.

What should be noted, though, is that power projects are not only about power-generation sources. They are inherently related to projects involving the construction of high-voltage lines. PSE’s expenditure on transmission lines has steadily increased in the past three years. Consequently, the amount scheduled for 2014 is only slightly lower from the combined figure for the past three years. The spending on projects involving the construction of distribution lines will mean multi-billion-zloty contracts that will be awarded to companies operating in this segment of the market. The value of investment projects involving the development electricity distribution lines will exceed PLN 40bn (€9.5bn) in 2014-2019, according to the investors.

Orders concerning the construction of production plants and warehouses are not so widely reported, but they are equally relevant to the industrial construction sector. Although the value of single projects is nowhere near the level of the power projects, the former represent as much as 50% of industrial construction’s output due to the number of these projects and the pace at which they are prepared and implemented. Also, they provide a highly stable form of occupation to construction enterprises, not only the big ones but also smaller, specialised companies.

The annual number of new industrial and warehouse buildings has been 3,100-3,200 in the recent years, of which around 70% have been reservoirs, silos and warehouses. However, buildings from the latter category have a smaller floor area, on average; hence their share in the total area of the buildings is a mere 54%. The remaining 46% of the floor area is represented by industrial buildings.

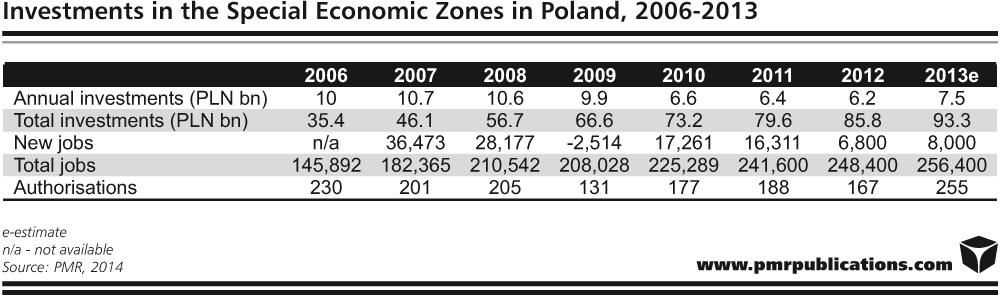

Most of the projects involving the construction of production plants in Poland are located within the special economic zones, which occupy nearly 16,000 ha in the country. The companies are attracted to these areas by financial incentives, which elevate the profitability of the individual projects to levels not seen anywhere else in the country. Additionally, the special economic zones are frequently better prepared to be home to the plants in terms of access to the required infrastructure.

The number of investment projects declined sharply in 2009. However, 2013 marked a big change in this respect – 255 authorisations for projects worth a total of PLN 7.5bn (€1.8bn) were issued last year. Paradoxically, poor financial condition of many construction companies was instrumental in driving the number of the authorisations – following the investment boom in civil engineering construction, these companies more often than not reported losses in their financial statements. With a view to improving their financial results, they engaged in new, less risky projects. A significant supply of building services available in the market greatly strengthened the negotiating position of the investors, which were able to choose from a large number of prospective contractors.

A negative change that the special economic zones will need to cope with in 2014 is the reduction of the available support amount. Currently, companies are entitled to receive financial support amounting to 50%, 40% or 30% of the project costs. However, in June, the limits of public aid offered to companies in selected areas will be reduced to 35% and 25% (the least developed areas will retain the 50% aid level). Changes regarding public aid will be introduced in all the EU states. To avoid the adverse impact of the revised policies, the companies will need to obtain the relevant authorisations by July 2014. Therefore, following an excellent 2013, the year of 2014 is expected to see a sharp rise in the number of authorisations issued.

Source: PMR

Tags Construction News

Constructionshows

Constructionshows