For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions of the market, whereas the non-residential subgroup remains relatively subdued.

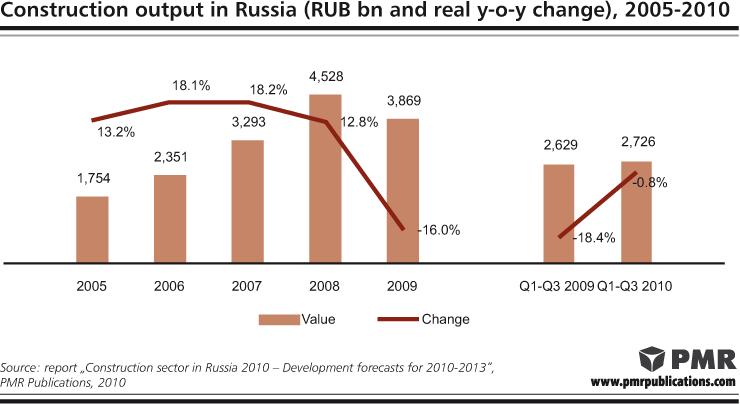

The Russian construction industry has survived its most difficult year for more than a decade. The 0.8% reduction recorded by the industry for the first three quarters of 2010 looks remarkably healthy in comparison with the 18.4% slump recorded last year, and construction firms are now much more optimistic about the future than they were just a few months ago. The most successful of them have concluded contracts worth billions of dollars and are planning to take on employees and purchase new building machinery.

The downturn served to emphasise the importance of the government to the construction market. As the flow of private investment into construction activity became markedly weaker, state-funded projects began to account for a more substantial proportion of construction activity. This is true of both infrastructure development and residential construction activity.

In civil engineering, the most extensive ongoing projects are those which involve preparations for the 2014 Winter Olympics in Sochi, the 2012 APEC Summit in Vladivostok and the 2013 Universiade in Kazan. For the Sochi projects alone, RUB 524bn ($17.5bn) has been allocated in the federal budget for the period 2011-2013. The projects associated with these three events are being treated as the highest priority and have already secured funding.

Despite continued support for construction projects, Russia’s federal budget has not emerged unscathed from the global economic downturn. The country, which, until recently, had operated on a substantial budget surplus, now faces a deficit which will hamper the government’s ability to fund projects other than those which are considered the most crucial. As such, the government is actively encouraging the involvement of the private sector in large projects, mainly through its support and development of public-private partnerships (PPPs). A number of concession projects have already been awarded: these include the Western High-Speed Diameter and, more recently, the $2bn first section of the Moscow-St. Petersburg motorway, the $1.8bn development of Pulkovo Airport and the $720m so-called Odintsovo Bypass. The legal framework for PPP projects is being constantly improved, with the aim of attracting the involvement of even more investors and construction companies.

Throughout 2009, private property developers struggled to obtain funding, and this impeded their activities. Credit has, however, recently become easier to come by, a development which augurs well for the future development of the industry. Between January and early September 2010, the amount of money loaned for construction purposes increased tenfold, to RUB 500bn ($16.7bn).

Given the above, growth is likely to resume in the Russian construction industry in the next few months, with full-fledged recovery expected in 2011.

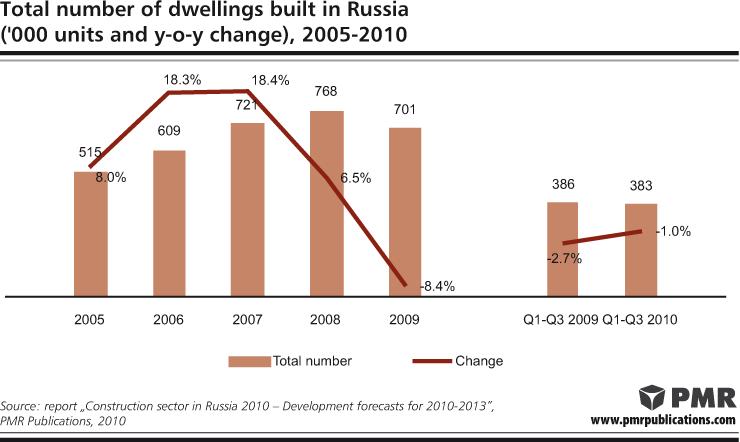

As mentioned above, the state has recently become an important player in residential construction through its provision of funding for the construction of new housing and the purchase of completed dwellings. With this support, the housing construction subgroup has avoided a major downturn, something which could easily have happened, as private developers have been finding it hard to secure funding for the completion of projects and the commencement of new developments. Residential construction for 2010 as a whole will be on a par with that of last year, with a slight, 2%, increase expected next year.

This press release is based on information included in the latest PMR report entitled „Construction sector in Russia 2010 – Development forecasts for 2010-2013”.

Constructionshows

Constructionshows