The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled “Construction sector in Poland, H2 2010 – Comparative regional analysis and development forecasts for 2010-2013”, after the challenging years of 2009 and 2010, the coming years will be marked by increased growth in the construction industry. Despite certain difficulties reported by construction companies, the twentieth edition of the report presents a quite positive view of Poland’s construction market.

Civil engineering construction will continue to be the main driver of growth in the Polish construction industry in the upcoming years. However, given the exponential growth in 2009 and, consequently, a higher base of comparison, civil engineering construction will register slightly weaker growth in the coming years, according to the report’s authors. Given the fact that a vast majority of civil engineering projects are public projects, some of them may be delayed. A serious risk is also posed by concurrent execution of so many large road projects as some of these projects can encounter various obstacles.

Compared to the forecasts of six months ago, development prospects for non-residential construction have slightly improved, mainly due to the stabilisation in commercial construction and expectations of continued increases in the public utility construction segment (growth of approx. 40% in 2010). Improvement will be also powered by the recovery in the financial sector, more dynamic growth of the Polish economy and a stronger inflow of foreign direct investments into Poland.

Despite the major slowdown in the housing market, long-term growth prospects for the sector remain positive. It should be noted that the crisis in the Polish housing market proved decisively less severe than commonly expected and its impact was much less acute when compared with most EU countries. Information published by the major developers in the recent months suggests that the supply of developer-built homes will partly recover already in 2010.

“In 2009, the developer construction segment caught up with the individual construction in terms of housing completions. Due to the major slowdown in new investment projects by developers in 2008 and 2009, we expect that individual construction will retain the status of the biggest residential construction segment. However, in the long term, developers’ contribution will rise more strongly as, in addition to multi-dwelling buildings, developers are more and more active in building smaller residential buildings, including single-family houses and residences, so wealthier Poles will decide to use developers’ services instead of building the house using their own means”, says Bartlomiej Sosna, Senior Construction Analyst at PMR and the report’s author.

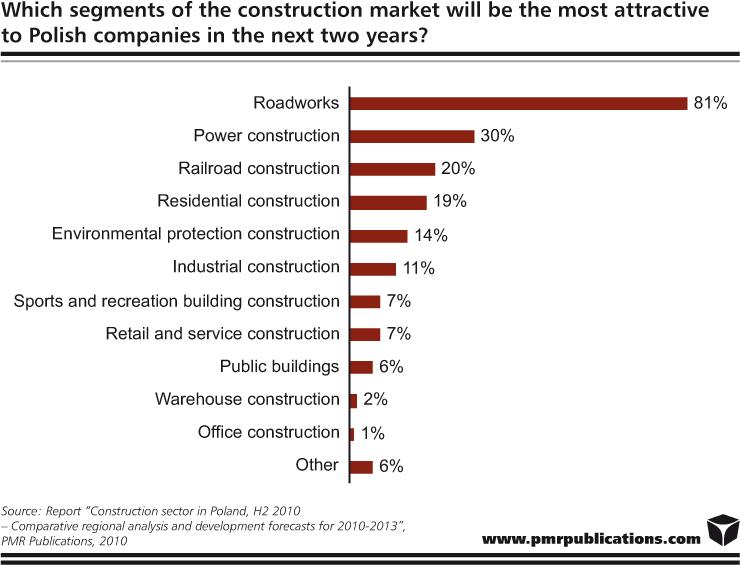

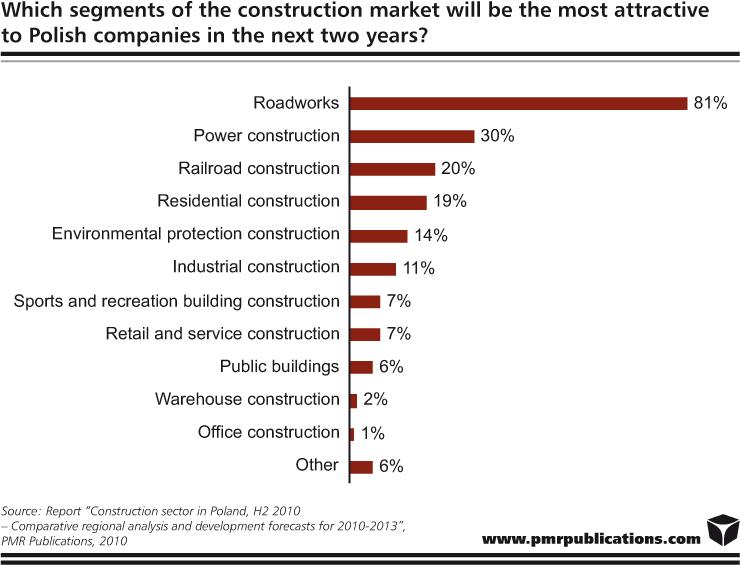

Development forecasts presented in the report are also confirmed by the opinions of the largest construction companies on the most promising segments of the construction market in a two-year time horizon. Traditionally, road construction is named to be the most attractive sector in the next two years – 81% of respondents shared this view. Power construction (including facilities for the power, gas and fuel industries) was ranked second in terms of attractiveness. Railway construction was considered to be the most attractive construction segment by one in five respondents – it marks a strong increase from a year ago (9% in September 2009). Residential construction was recognised to be a prospective sector by a roughly similar percentage as the railway construction (up from 12% a year earlier).

Environmental protection construction (sewage treatment plans, sewage systems, pipelines), which was the third most attractive segment of the construction market in the previous editions of the survey (31% in September 2009), garnered 14% of responses. The industrial construction segment (industrial plants, production halls, etc.) was mentioned by 11% of respondents.

While in the corresponding period of 2009 the construction of sports and recreational facilities was recognised to be the most attractive sector of the construction market by one-third of respondents, only 7% of respondents to the latest survey mentioned sports and recreational facilities, due to the highly advanced stage of most stadiums’ construction.

This press release is based on information contained in the latest PMR report entitled “Construction sector in Poland, H2 2010 – Comparative regional analysis and development Forecasts for 2010-2013”.

Constructionshows

Constructionshows