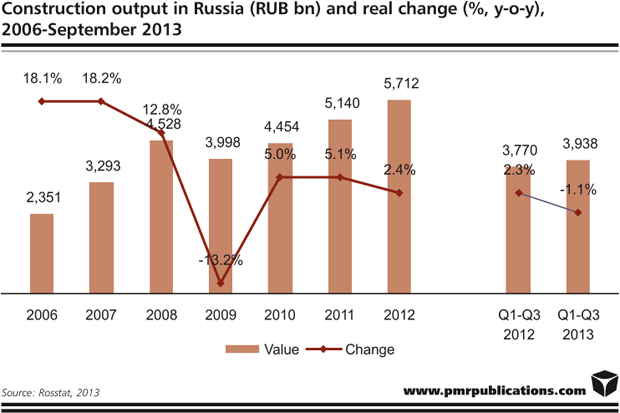

As indicated by the results of PMR’s latest report, “Construction sector in Russia H2 2013 – Development forecasts for 2013-2016”, Russia's construction industry is projected to ease its annual expansion pace to 0.3% in 2013, down from the 2.4% growth seen a year ago.

The Russian construction industry has recorded a significant slowdown over the past few quarters. In 2012 Russian construction output grew by only 2.4% in year-on-year terms, after a couple of years of at least 5% growth rates. It is worth mentioning that the market grew more in the first half of 2012, primarily due to the unseasonably warm winter, with expansion easing from 8.5% in January to 4.7% for H1 2012. In 2013 the industry’s growth pace has not accelerated. On the contrary, for the first three quarters of the year it shrank, albeit no more than 1.1%. Among the key factors contributing to the deceleration in construction industry growth rates are the high base set after two years of strong recovery, the slowdown of the Russian economy, the still challenging fundraising environment, and intensifying capital outflow.

Strong growth rates in 2010 and 2011 were fuelled by many new launches and the revitalisation of suspended projects, supported largely by the recovery in oil prices and an improvement in business sentiment. However, since 2012 the economic growth has started to decelerate, even though oil prices have been steady at above $90-100 per barrel, a price level which allows the country to balance its federal budget. Russian officials blamed the modest economic progress on a weak external demand from key export markets, particularly the EU, and a slowdown in investment. Subdued macroeconomic activity in Russia has worsened the investment climate, with a substantial number of projects being reassessed, even many of those state-supported targeted programmes, including residential and transport infrastructure development programmes.

Russia's construction industry in Russia struggled in H1 2013, contracting year on year by 1.9%. By September, the downward trend in construction activity eased, and for the nine months a 1.1% drop in construction output was recorded in the country. According to PMR estimates, the market was dragged down solely by the civil engineering construction sector. Russia’s federal budget for 2013 was set based on a projected GDP growth of 3.7%. However, according to the performances achieved in the first three quarters, this year GDP is likely to expand by 1.8% at best. Among the key factors behind this slowdown has been the poor performance in investment activity. Russian authorities expect investment in fixed capital to expand 2.5% in 2013, a figure unlikely to be achieved considering that in the first three quarters of the year investment in fixed capital contracted by 1.4%. The decline in investment has partly come after many Russian large companies scaled back their investment programmes for 2013. Furthermore, weak macroeconomic performances have forced public authorities to slash this year's projected spending on targeted state-run infrastructure development programmes.

The non-residential construction sector has seen a strong uptrend in recent years. According to Rosstat, a total of 18,341 non-residential buildings were activated across the country in 2012, 15.1% more than a year earlier. Strong double-digit growth rates were also recorded in total space and total volume of new non-residential supply last year, with total new space supply exceeding 2011 by 30%.

The positive trend continued in 2013. Preliminary data show a total of 10,071 non-residential buildings were commissioned in Russia during the first three quarters of the year, exceeding by 6.5% the number recorded during the same period a year ago. The total floor space of new buildings surged by 24.7% year on year. At the same time, new projects were 17% larger on average. The most impressive growth was seen in the educational building sector, where the number of such schemes activated in Q1-Q3 2013 grew by 21.5% to 317. Strong performance was also achieved in the construction of administrative buildings, where the number of such schemes put into use totalled 669, 19% more year on year, and in the construction of commercial buildings, where 18% more such buildings were activated over the period.

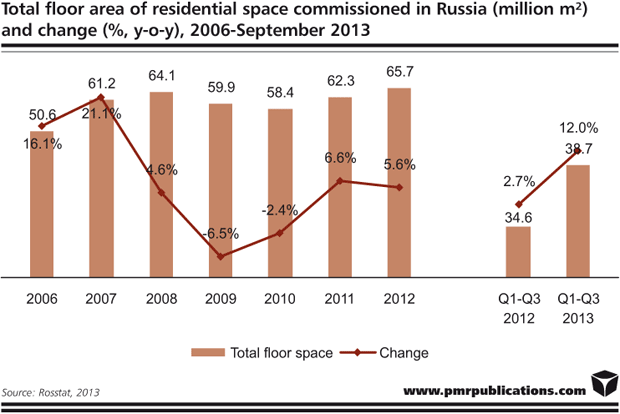

Strong growth has been also witnessed in residential construction, with the number of new homes activated in 2012 increasing by 6.7% year on year to 838,000, the largest during the past two decades. The record achieved last year will be improved in 2013. Between January and September, about 485,300 new dwellings were put into use across the country, 18.8% more than during the same period a year before. The total floor space of residences put into use in 2012 increased by 5.6% to 65.7 million m², again the highest figure since 1990. It is worth noting that the highest yearly housing completion figure ever recorded in Russia was in 1987 (72.8 million m²). During Q1-Q3 2013 another 38.7 million m² of residential space was commissioned in Russia, outperforming by 12.0% the result achieved in the corresponding period last year.

Source: PMR

Constructionshows

Constructionshows