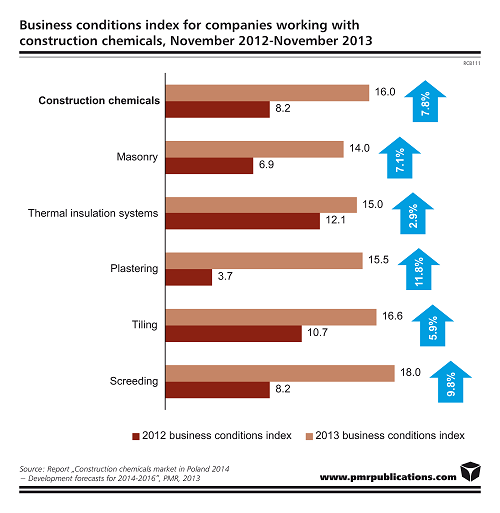

Limited activity of investors in the residential construction market in 2014 is expected to lead to another poor year for the manufacturers of construction chemicals in Poland as the market is poised to shrink by several percent again. However, the upturn is getting closer, as confirmed by improvement in the business confidence indicator for the construction chemicals industry, which rose from 8.2 pts in 2012 to 16 pts at the end of 2013.

According to PMR’s latest report entitled “Construction chemicals market in Poland 2014 − Development forecasts for 2014-2016”, the construction chemicals market is expected to shrink, again, by about 7% in 2014 after a 6% fall recorded in 2013. Declines in this segment of building materials will be driven by poor performance of the residential construction sector, which consumes about 80% of construction chemicals in Poland. PMR’s researchers expect that the floor area of housing projects completed in the country will continue to fall, going down to 13 million m² in 2014, compared to 16.5 million m² in 2008, which was the best year for the construction chemicals sector. The floor area of new housing developments is projected to start growing again in 2015.

A stronger outlook for the construction chemicals industry in 2015 and onwards is also confirmed by the third round of the survey of 300 small- and medium-sized renovation and construction companies conducted for the purpose of the report. Assessments of the current situation and expectations for the future in terms of financial standing, backlogs of orders and employment levels reveal a more optimistic outlook than in the year before. As a result, the value of the business confidence indicator for the construction chemicals market in Poland stood at 16 pts, compared to 8.2 pts in last year’s study and 14.7 pts two year before.

How the surveyed companies perceive the outlook for 2014 is largely driven by the type of work in which they are involved. According to the specialisation area, PMR’s confidence indicator for the sector has the highest values for companies specialised in laying screeds and tiling companies, though other segments show only marginally poorer performance. Significantly larger differences in the index were presented in the previous wave of the survey.

As indicated by the survey results, all renovation and construction companies using construction chemicals, regardless of the type of work performed, most frequently buy the goods from building wholesalers. The highest proportion of responses for building wholesalers concerns thermal-insulation systems and masonry mortar (approx. 90% of responses), while tile adhesives and masonry mortar gained 80% of responses each. Regarding floor screeds, this share was about 60%. DIY stores are an alternative shopping place as they are more popular among smaller construction companies. The key advantages of DIY stores include low pricing and a convenient location.

The latest report issued by PMR also reviews the trends affecting the construction chemicals market and the related segments. “A marked decline in the share of ceramic materials in masonry work accompanied by a concurrent rise in the use of aerated autoclaved concrete blocks is the most salient trend emerging from the results of the latest edition of the survey. The blocks have become the most popular wall-building material in Poland. This shift also resulted in a great upsurge in the popularity of thin-joint mortars, which gained market share at the expense of thick-joint mortars”, Bartlomiej Sosna, Head construction analyst at PMR and the author of the report, said.

Source: PMR

Tags Construction News

Constructionshows

Constructionshows