Between the peak recorded in 2007 and the trough of 2008-2010, the value of construction works carried out in Ukraine plunged by 70% in real terms. Residential construction was hardest hit by the crisis and, while the housing sector is yet to recover, overall market development in the country does give cause for hope that the worst has now passed for the Ukrainian construction industry.

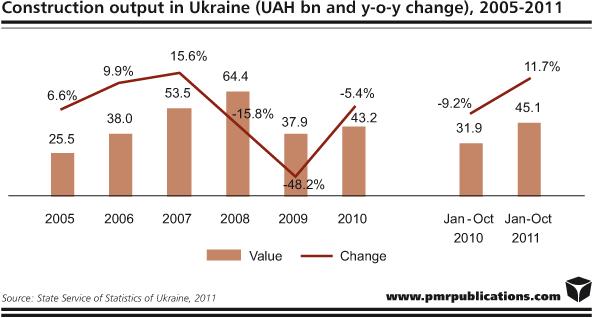

Last year, the Ukrainian construction market continued the downward trend on which it has been on since 2008. Total construction output decreased by 5.4% in real terms and the construction of buildings declined at double the speed. On the other hand, the value of works related to the preparation of construction sites rose by 10% and the construction of roads and airports increased by 23%.

In 2011, construction output in Ukraine has started to grow largely due to the intensification of preparation works for the Euro 2012 Football Championships. During the period January-October 2011, the value of construction works carried out in Ukraine increased by 11.7% in real terms, and by almost 42% in nominal terms, to UAH 45.1bn ($5.6bn). Therefore, the value of construction in the first ten months of the current year has already exceeded the total value for the whole of 2010.

Broken down by segments, the most robust growth in January-October 2011 was observed in the construction of buildings and structures, by 12.9%, followed by the preparation of construction sites, where a 12.1% increase was recorded. Works related to the installation of equipment in buildings and structures grew by just 2.3%. In finishing works, value continues to fall, by 10.8% in the first ten months of the 2011.

Of the total value of construction output between January and October 2011, 79.4% was accounted for by work on new constructions, reconstruction and modernisation, while general overhaul activities account for 14.1% with maintenance accounting for 6.5%.

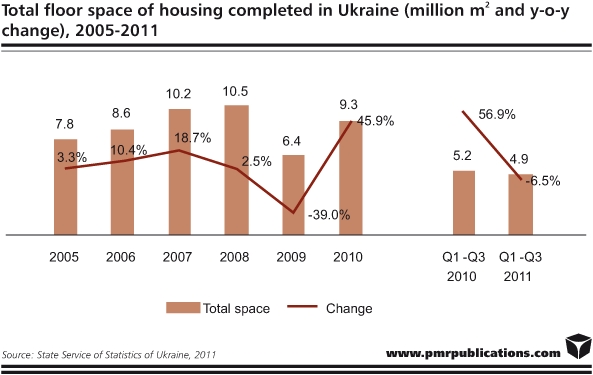

The onset of the economic crisis and the accompanying liquidity squeeze resulted in a sharp drop in housing construction in 2009. Banks ceased to provide financing for developers, who, as a result, quickly ran out of cash and were forced to put their projects on hold. Individual investors also found it virtually impossible to obtain financing for their planned housing projects. Growth in personal income – and so peoples’ ability and willingness to buy property – has also stalled during since this time.

Residential construction activity picked up slightly in 2010, although banks remained extremely cautious with regard to financing property development projects. This was compounded by the government’s inability to support the mortgage loan market to the desired extent. Last year, the state accounted for just 0.5% of total investment in housing construction while bank loans accounted for 4.4%. Funding coming directly from construction companies and developers accounted for 7.7% of the total figure. Private individuals’ investment in the construction and modernisation of their own dwellings accounted for 16.6% and investment in individual housing construction accounted for 57.8%.

In 2010, the number of dwellings completed and put into use increased by 17% and total floor space put into use increased by 45.9% in comparison with 2009, however, most of this growth stemmed from the fact that many investors used the opportunity created by the government’s issue of a Temporary Order that made it possible to register residential buildings built earlier without a building permit in place.

Relatively poor figures for 2011 have proved 2010 to be a one-off surge in completion statistics – the number of housing units completed was down 3% and the total floor space completed fell by 16% in H1 2011. In the third quarter of 2011, however, housing completion picked up, thus reducing the overall Q1-Q3 year-on-year decline to 6.5%.

This press release is based on information contained in the latest PMR report entitled “Construction sector in Ukraine 2011 – Development forecasts for 2011-2014”.

Latest Events News

- Executive Hire Show 2026 delivers business, innovation and record engagement at CBS Arena

- Steve Vick International to make Executive Hire Show debut with Renset power station

- Innovation Trail highlights the kit shaping hire’s next chapter

- Registration Now Open for 2026 National Heavy Equipment Show

- Build Your House Saudi & Inspire for Home KSA Launch in Riyadh — Bringing Qatar’s Premier Home & Lifestyle Exhibitions to the Kingdom

Constructionshows

Constructionshows