The construction industry remains one of the key catalysts of economic growth in Russia. Its role is expected to strengthen in the years to come as the government aims to undertake multi-trillion rouble investments in order to modernise and expand the country’s infrastructure.

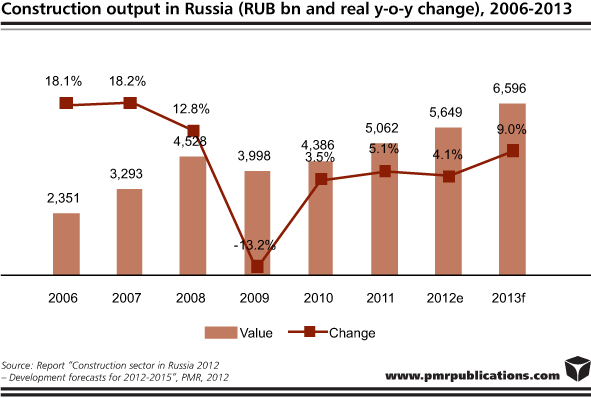

According to the research company PMR’s latest report, entitled “Construction sector in Russia 2012 – Development forecasts for 2012-2015”, the Russian construction industry is still struggling to gain momentum. After 9.2% y-o-y growth in the first two months of 2012, mostly on the back of the unseasonably warm winter, the value of construction work carried out in Russia increased by only 3.2% in the January-August time frame. This deceleration of growth rates is certainly fuelled by the high base effect and by the economic slowdown.

In 2011, driven by a recovery in business sentiment, many construction projects were implemented, which, along with new launches, included the revitalisation of a large number of frozen projects. This year, the upsurge in Europe’s debt crisis began to have an adverse effect on the investment climate, with a large number of projects being reassessed. On-going construction projects have continued, but new developments have been scarce in number and size, and this ultimately reined in the expansion of the still fragile construction industry in Russia. Nevertheless, for 2013 PMR analysts forecast an acceleration of market growth to 9%, propelled by easing global macroeconomic unrest, the speeding up of state-funded target programmes, especially related to the residential and road construction segments.

In H1 2012, RUB 73.2bn ($2.4bn) were invested in fixed capital in the construction industry, a 2.6% reduction in comparison with the corresponding period of 2011. This stands as another indication of the still fragile business confidence across the Russian construction sector. During this period, Moscow maintained its leading position in terms of construction output value among Russia’s federal areas, with an 11.4% market share. The next two leading regions in terms of construction output are Krasnodar Territory and St. Petersburg.

In 2012, the Russian construction sector was kept going mostly by civil engineering projects supported by the public sector, as private entities remained reluctant to commence new initiatives in a period of deteriorating economic conditions. Multi-trillion-rouble, state-funded target programmes aimed at modernising the country’s transport network, energy industry, and social infrastructure played an important part in the evolution of the industry over the first three quarters of the year. An additional boost was provided by large-scale preparations for the 2014 Sochi Winter Olympics.

Civil engineering projects are responsible for more than 50% of the country’s construction output. This dominance reflects large-scale infrastructure projects which are financially supported by the government, along with modernisation initiatives on the part of companies in the key areas of the Russian economy: the oil and gas industry, metals, and the energy industry. The road construction industry has been one of the major consumers of public investment in recent years.

With regard to the non-residential construction market, it continues to gain ground, especially in the retail real estate segment. Overall, substantial year-on-year increases in the number of non-residential buildings completed and their combined floor space was recorded during the first half of the year. In terms of the number of completed projects, the most substantial upsurge was witnessed in educational buildings (38.9%), which was followed by commercial and industrial projects − 30.1% and 29.8%, respectively. The recovery of the property market is confirmed by the increase in number and size of investment transactions concluded on the secondary market. In H1 2012 the two largest investment transactions ever witnessed on the commercial property market in Russia were concluded, with the acquisition of the Galeria shopping centre in St. Petersburg for $1.1bn by Morgan Stanley at the top of the pile.

The residential construction segment is posting strong performances as well. The total floor space of residential properties commissioned in 2011 increased by 6.7% to 62.3 million m², which is the second largest figure of the past two decades. In the first half of the year, 26.1 million m² of housing were activated, 7% more than the level recorded in H1 2011, and it is highly unlikely that the rate will lose steam in the second half of the year.

In recent months, the government has approved several legal initiatives to boost the construction industry in Russia. In August 2012, the government approved the Construction Road Map plan, designed to improve the business climate in the construction industry. According to the plan, the number of procedures which will be needed to obtain a building permit should be reduced from the current 51 to 15 by 2015 and to 11 by 2018, and the period needed for all of these mandatory processes will be reduced from the current 423 days to 130 days by 2015, and to 53 by 2018. This includes more rapid approval of site related documentation. In addition, the Residential Construction Support Fund will, through tenders, use its reserves to provide land, free-of-charge and for a fixed period, for the construction of economy class homes. Sites will be awarded to the company offering the lowest sale price for its proposed properties.

This press release is based on information contained in the latest PMR report entitled ”Construction sector in Russia 2012 – Development forecasts for 2012-2015”.

Tags News

Constructionshows

Constructionshows