PMR believes that, in recent years the replacement of ageing power-generating facilities has been the main driver for new investment in the energy sector construction market. The Russian power sector has undergone substantial reform over the past few years. The restructuring was aimed at ending the state monopoly of the power sector and the formation of a competitive power market.

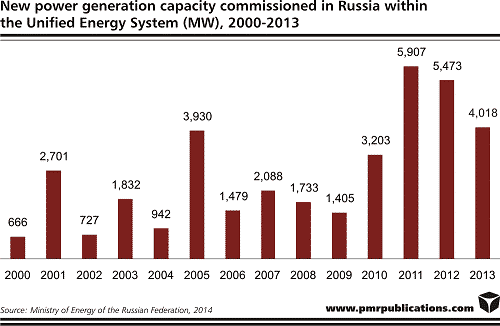

As indicated by the results of PMR’s latest report, entitled “Power sector construction in Russia 2014. Development forecasts for 2014-2019”, the ageing power infrastructure in Russia, the rapid pace of modernisation, and the expansion of the country’s power generating capacity and capabilities together encourage a positive outlook for the energy sector construction market. Despite certain challenges in overcoming the financial crisis of 2009-2010, this market has demonstrated dynamic growth since 2009 with over 3 GW of new generating capacity activated across the country every year. In 2013, 4,018 MW of new generating capacity were completed within the Unified Energy System of Russia, standing for the third best performance in more than two decades. Nearly 49% of the capacity added in 2013 was developed under Capacity Provision Agreements (CPAs), a mechanism providing the generating companies with a guaranteed return on investment. Among the projects that were delivered outside the CPA scope are three generating units (3×333 MW) at Boguchanskaya HPP, Tereshkovo gas-fired TPP (170 MW), CHPP fired by waste gased from NLMK’s blast furnaces – (3 generating units, 150 MW), Kurgan CHPP-2 (2 generating units, 2×113 MW), Novokolpinsk CHPP (1 generating unit, 110 MW).

New TPPs made up 75% of the new capacity. Three generating units at Boguchanskaya HPP (999 MW) were the only HPP projects activated in 2013, contributing 25% to the total newly installed generating capacity across the country last year. As for the nuclear power sector, no new reactors were put into use in Russia in 2013.

After the post-crisis recovery period, electricity consumption dynamics in Russia have decelerated. In 2013, consumption is estimated to have contracted by 1.6%, mainly due to the weak performance of industrial production, which expanded year on year by only 0.4%, and the increasing use of energy-efficient electronic systems.

In 2011, the Energy Forecasting Agency in Russia released its prediction for the evolution of power consumption in Russia up to 2030. Despite the likelihood of achieving the figures stated being very slim, the report says that electricity consumption in Russia is to increase to about 1,132bn kWh by 2015. However, according to PMR, consumption in 2015 is not expected to exceed 1,100bn, taking into account factors such as the 2013 result (1,046bn kWh), the modest economic growth projected for the next couple of years – GDP growth rates will not exceed 2.5%, and the increasing use of energy-efficient appliances and equipment.

Currently the Ministry of Energy is implementing the Power Sector Modernisation Programme for the period 2013-2019; the initiative calls for the modernisation of outdated facilities, the construction of new generating capacities, and the implementation of energy saving measures based on advanced technologies. The programme outlines plans for a total investment of RUB 3.3tr (€67bn) by 2019. Of this, RUB 1.75tr (€35bn) is to be used on the development of the generating and RUB 1.59tr (€32bn) on high-voltage (above 220kV) power grid.

The healthy growth in electricity demand in the future will definitely drive the need for more power generating capacity and, consequently, an expected increase in activities in the energy sector construction market in the years to come. According to PMR, among the best performing businesses will be those involved in implementing energy-saving initiatives, given the prospects for further increases in electricity prices. Large energy-intensive industrial companies have begun to face possible uncompetitiveness as domestic electricity prices for industry approach those seen in more developed countries.

Another important driver for a more dynamic power construction sector in the coming years will be privatization, cited by the government as one of its priorities. The government plans to carry out wide-scale privatisation of electric utility companies in the near future. However, given the current unfavourable market conditions and the high degree of uncertainty in the electric utilities industry in Russia, this seems unlikely to happen this year. There is currently no clear indication of which companies may be sold to private investors. The decision on the privatisation of regional grid companies was postponed for 2014, though there have been expectations of a launch of these initiatives last year.

A peculiar issue in this regard is the role of Rosneftegaz. Over the last couple of years Rosneftegaz has been actively striving to expand its control over Inter RAO, RusHydro, and Russian Grids, mostly through recapitalisation. These plans do not look like privatisation, given the fact that Rosneftegaz is 100% state-controlled. However, currently there is no consensus among officials on the company’s future role.

Source: pmr

Tags Construction News

Constructionshows

Constructionshows