In 2013 the first signs of stability in the Slovak construction sector are expected. After a slump in public investment in 2012, civil engineering is expected to recover slightly, driven by the use of EU funds to conduct large infrastructure projects which had been delayed. Furthermore, non-residential construction output should remain at similar levels as in 2012 and may even slightly increase given the expected rise in investment outlay in the automotive industry.

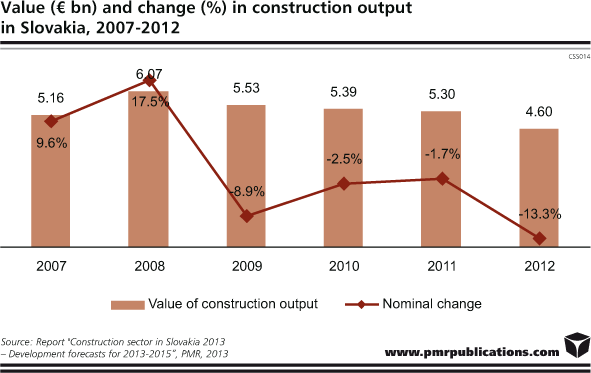

According to PMR’s latest report; “Construction sector in Slovakia 2013 – Development forecasts for 2013-2015”, 2012 saw the Slovak construction market register a fourth consecutive year of decline and the worst negative result since the economic crisis hit the country, of more than 13% year on year. That year also saw total construction output in the country go below the €5bn threshold.

The main causes of the drop were shaken confidence among investors, falling liquidities, a lack of funds for new investment, and the consequent declining demand for construction work. However, the government’s plans to invigorate the sector by increasing state investment in transport infrastructure construction, particularly roads, are likely to help the industry alleviate the decline. PMR analysts expect that the country’s construction output in 2013 may match the 2012 figure at best, mostly thanks to minor growth in both residential and non-residential construction. With the economic climate expected to improve in the next few years and demand for construction likely to recover, PMR’s report highlights why Slovak construction output is expected to return to growth in 2014.

The government has already signalled its serious intention to help civil engineering construction pick up by pledging funding for transport infrastructure construction. However, if these plans are carried out, the effect will only be seen after 2013. However, even that will depend on the speed of tendering the road and rail infrastructure construction projects in the coming years, as well as on the availability of funding for such construction.

In February 2013, the government confirmed its plans to massively fund road infrastructure construction in the coming years. By the end of 2015, it wants to have contracted all the road infrastructure work covered by the EU funding programme 2014-2020 and have construction underway between 2015 and 2020. As a result, in the years to come, road infrastructure construction, particularly motorway and expressway construction, is expected to receive a new impetus.

The report also looks at non-residential construction where, after a significant slump in 2012 due to the country’s prolonged economic crisis that prompted many investors to hold back, it is expected to finish 2013 with slight growth. Although some segments, such as industrial and warehouse construction and hotel construction, are still dormant, demand for office space is recovering slowly and a number of retail projects are being reactivated. These are likely to push non-residential construction up in 2013.

Residential construction is expected to more or less stagnate in 2013. Despite the announcement of a number of projects in Slovakia, the appetite for such construction is still low and developers remain sceptical about projects that will finish in 2013. Low mortgage rates may help the sector recover slightly but residential construction is likely to see an increase from 2014 as the demand for residential space is expected to surge and the availability of flats decrease.

Source: PMR

Tags News

Constructionshows

Constructionshows