– Heterogeneous business performance in sectors of the industry

– Total industry sales in 2001 higher than expected

The mid-year business situation is highly diverse for companies in the German construction equipment and building material machinery industries. While some sectors are beginning to approach their record revenue levels of 2007/2008 again, others are still going through a valley of sorrow.

Nevertheless, VDMA, the German Engineering Federation, is working on the assumption that – thanks to good developments in construction machines – the 10 percent revenue growth, projected for the entire industry early this year, will actually be higher. In 2010 the German construction equipment and building material machinery industries recorded sales of 10.6 billion euros. Of this amount, 6.3 billion euros accounted for the construction equipment sector and 4.3 billion euros for building materials, glass and ceramic machinery.

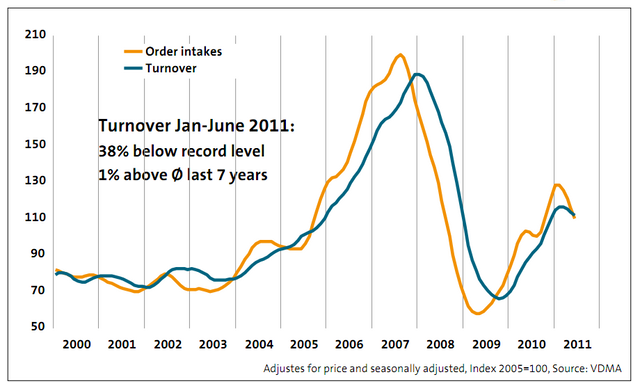

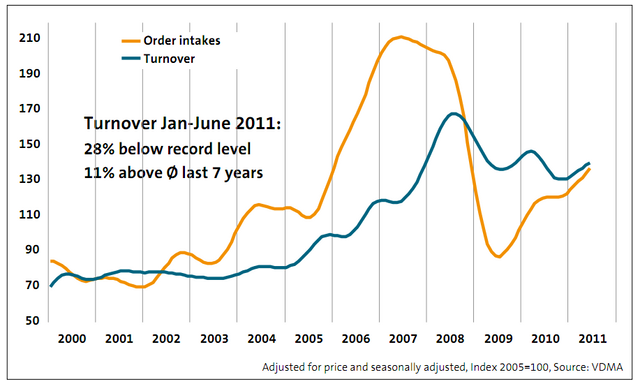

During the first half of 2011 sales in construction equipment reflected the average of the past seven years, but were still 38 per cent below the record level of 2008. In building material machinery sales were 11 per cent above average and 28 per cent below the record level. “Although profits are being made in some sectors again, there are no grounds for excessive euphoria,” said Dr. Christof Kemman, Chairman of the VDMA Construction Equipment and Building Material Machinery Association at a recent board meeting in Schrobenhausen. The debt crises in Europe and the United States and the unrest in the Arab world are causing plenty of uncertainty for the future. And the capacities which grew so much during boom times are still far from being fully used again.

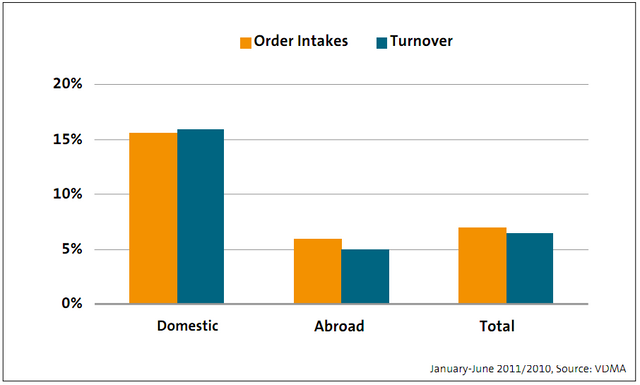

As before, business is mainly being stimulated from outside Germany. But Germany’s domestic market, too, is developing very well, with growth rates in incoming orders and sales above those in other countries. However, the stormy demand that still pervaded the industry in 2010 and the first quarter of 2011 has come to a halt for the time being. “But it’s too early to say whether this downturn in new orders is actually indicating an end to recovery and pointing to a turnaround,” says Sebastian Popp, VDMA’s economic expert in construction equipment and building material machinery. The strong fluctuations in demand are still requiring companies to be highly flexible in their production with mastering this them coming close to their limits.

Manufacturers are equally rather concerned about their suppliers who are apparently also struggling with fluctuations. Companies from all sectors are reporting bottlenecks in the delivery of components and problems with the quality of the delivered parties. Also, price increases are often far from plausible.

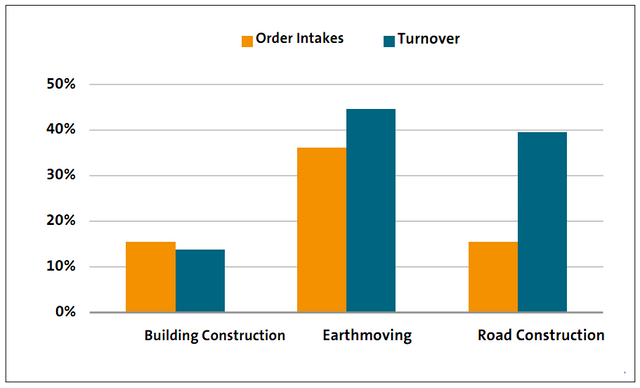

Building construction equipment

Building construction equipment is still taking the greatest battering within the industry. Business has been particularly weak in concrete engineering this year. This applies above all to the sluggish but nevertheless important markets of North America, Southern Europe and the MENA region. The only area where those losses were compensated was India, where business has been developing brilliantly. Tower cranes continued to sell at a very low level. The only equipment that did not follow this negative trend was building hoists, where excellent growth was in evidence during the first half of the year. The only counter-effect has been coming from poor prospects in North America, a market that is important for this sector.

Earth-moving, civil engineering and tunnelling equipment

Manufacturers of earth moving equipment have reported encouraging developments in both German and foreign markets. Especially the Asian countries, Russia and South America have contributed considerable stimuli. Although demand eventually slowed down again, the sector is nevertheless on its way towards a generally very good year. Special civil engineering equipment is currently behind the general cycle. Having reached its crisis relatively late, in 2009, demand is still developing rather sluggishly. The two most hopeful markets are Russia and the United States. Tunnelling equipment has recorded the lowest level of fluctuation, due to the long-term nature of this sector, and continues to experience moderate growth and a good level of demand.

Road construction equipment

Manufacturers of road construction equipment are presently reporting the greatest growth in demand. The only sector that is lagging behind this development is that of asphalt mixers. As with earth moving equipment, there has been a recent decline in demand. Manufacturers are therefore expecting weaker growth for 2012. Growth markets include China and India and continue to include the United States and the Middle East. In Europe good developments can be observed in Scandinavia.

Cement, lime and gypsum plants and processing equipment

The cement industry continues to go through a weak period, so that there is no stimulation for equipment and machinery manufacturers. On the other hand, prospects are clearly more positive for suppliers to raw material extractors and processors. This sector is likely to see an almost two-digit sales growth at the end of the year. Despite the recent unrest, the most attractive markets continue to be the countries of North Africa. Moreover, positive stimuli are coming from Asia, and in fact not merely from China and India.

Concrete block and slag machinery

After a weak year in 2010, greater growth can be observed in concrete block machinery again. The industry is expecting to see a good double-digit sales increase compared with last year. Backlogs are currently so high that 2012 should get off to a good start. The most promising markets can be found in Asia, especially China and India. Business is also developing positively in the CIS countries again – despite financing difficulties. North America continues to be unavailable as a sales market. Also, companies are beginning to feel the current tensions in the Middle East and Northern Africa.

Charts

Development of incoming orders and sales in sectors of the industry

Source: http://www.vdma.org

Constructionshows

Constructionshows