On the back of an excellent start into 2011, the full year’s construction output will increase by around 11%, mostly driven by dynamic implementation of large civil engineering projects. However, the construction sector is likely to grow slower in the years 2012 and 2013. According to contractors, the appeal of residential and railway construction segments was boosted over the past year, while the attractiveness of road construction, environmental construction and sports facilities construction declined.

The twenty-first edition of the report “Construction sector in Poland, H1 2011 – Development forecasts for 2011-2013” published by the research company PMR painted an improved outlook for the construction market for 2011. However, projections regarding the situation in the sector in 2012 and 2013 had to be adjusted.

After an excellent start into the new year for the construction industry (up by nearly one-fifth in Q1 2011), which was partly due to a low base of comparison, the authors of the report expect that the pace at which the construction segment will grow in the remaining part of the year will steadily fall. Consequently, the full year’s growth will be around 11%, which is set to be the highest result shown by the construction sector since 2008. Construction output growth will slightly slow in 2012 and 2013, principally in the wake of a reduced number of new civil engineering projects.

According to the report’s authors, civil engineering construction will continue as the driving engine for the construction sector in Poland in 2011 and 2012. The reason behind the leading role to be played by the civil engineering segment is expected to be the dynamic implementation of large civil engineering projects related to Euro 2012 hosted by Poland. Solid growth will also be fuelled by capital expenditure on water supply and sewage discharge infrastructure projects, in both small and large urban agglomerations, and by railway construction projects, especially those concerning the Warsaw-Gdynia and Katowice-Rzeszow lines. Furthermore, the power sector is expected to accelerate – the number of planned investment projects in this branch has steadily grown, but they will be implemented over extended periods of time and will start to yield substantial revenue only after 2013 when proceeds from road construction projects are set to decline.

However, the outlook for non-residential construction has improved considerably in the last few months. Due to a low base of comparison and, additionally, driven by the renewal of numerous commercial construction projects, after a 4% decline recorded in 2009, non-residential construction accelerated significantly in H2 2010 and ended the year on a positive note. In 2010 public utility buildings were another major market force, in addition to commercial buildings; however, this sub-segment can lose some of its significance in the coming years due to restrictions on local governments assuming further debt. Yet, on the back of improvement in the financial sector and more dynamic growth in the Polish economy, the share of large commercial construction projects, in particular retail and office schemes, will increase in the forthcoming years.

Concerning residential construction, property developers had suspended many large projects, which pushed residential construction and assembly output down by around 10% annually in 2009 and 2010; this, however, should be deemed a relatively good result compared to other countries in the region which were subject to much more intense pressures. Therefore, due to the growing activity of the major developers, PMR researchers expect that residential construction output will start to grow in 2011 and in the subsequent years. But it should be noted that the output’s value should grow at up to 20%.

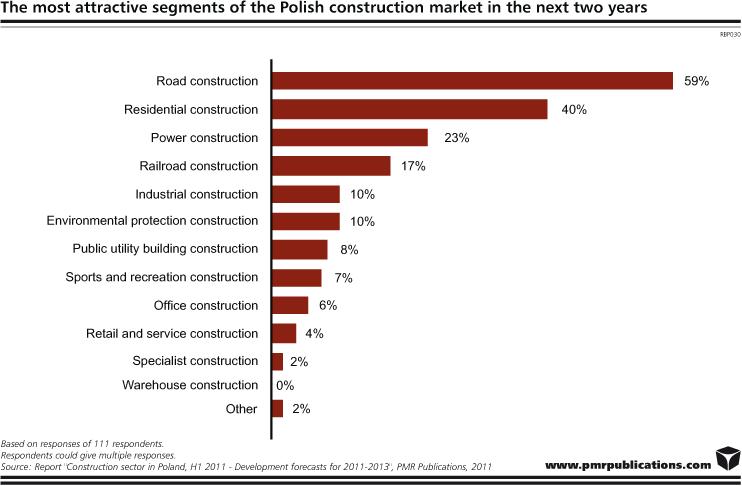

Since the first round of the survey of the 200 largest construction companies, road construction has been named as the most attractive construction segment in a two-year time horizon. As could only be expected, the results of the last survey confirmed this tendency – road construction was named by 59% respondents as the most attractive sector of the construction market in the next two years. Admittedly, this is a much lower proportion compared to March 2011 (76%) and September 2010 (81%). The decline is a direct result of the government cutting down plans regarding national road construction projects, reduced spending by local governments and the approaching end of the local road reconstruction plan.

Concerning sector attractiveness, residential construction recorded the strongest growth in the past year, as mentioned by a steep 40% of respondents, compared to less than 20% in 2010. The strongest influence on the residential construction segment will be exerted by developer-built construction which accelerated strongly in 2010, as opposed to single-family housing construction. The number of dwellings started by developers jumped by 42%.

Power construction (including facilities for the power, gas and fuel industries) was ranked third in terms of sector attractiveness, garnering 23% of responses. In March 2010 and September 2010, it was selected by 27% and 30% respondents, respectively. Accordingly, combined with delays in the preparations of power projects, contractors’ confidence about prompt implementation of these projects has been falling. However, taking into account a longer time scale (subsequently to 2013), power and industrial construction contracts will largely compensate companies for reduced projects in the road construction segment.

Railway construction was considered to be the most attractive construction segment by 17% of respondents, compared to 11% in March 2010 and 20% in September 2010. As far as the industrial construction segment is considered, its appeal has continued roughly unchanged for several quarters (12% in March 2010, 11% in September 2010, 10% in March 2011). However, there was a significant fall in the attractiveness rating for environmental protection construction (down by 14 p.p. year on year). Office construction is at the opposite end, gaining more and more popularity (up by 5 p.p. from September 2010).

This press release is based on information contained in the latest PMR report entitled „Construction sector in Poland, H1 2011 − Development forecasts for 2011-2013”.

Source: PMR

Latest Events News

- Executive Hire Show 2026 delivers business, innovation and record engagement at CBS Arena

- Steve Vick International to make Executive Hire Show debut with Renset power station

- Innovation Trail highlights the kit shaping hire’s next chapter

- Registration Now Open for 2026 National Heavy Equipment Show

- Build Your House Saudi & Inspire for Home KSA Launch in Riyadh — Bringing Qatar’s Premier Home & Lifestyle Exhibitions to the Kingdom

Constructionshows

Constructionshows