After a difficult 2009, when there was a reduction of more than 20% in the consumption of cement in the region, the cement markets in the countries of the former Soviet Union are expected to witness growth again. In the longer term, per capita cement consumption in the CIS countries – with their immense infrastructure development and housing needs – should increase steadily and match the levels observed in the more developed countries. With a view to increases in demand in the future, local producers are boosting their cement production capacities.

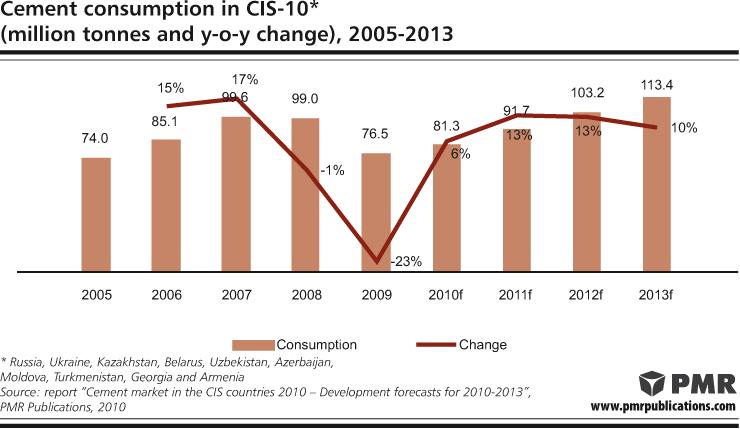

In terms of volume, the combined consumption of cement in the ten countries grew at an AAGR of 14% between 2003 and 2007 and reached a peak of 100 million tonnes in 2007. This was followed by a slight, 1%, reduction in 2008. During the following year, the majority of cement producers in the region witnessed a reduction in demand for their produce, with the steepest declines seen in Russia and Ukraine, the two largest CIS cement markets. On the other hand, countries such as Uzbekistan and Turkmenistan proved resilient to the global downturn and saw their cement consumption grow by 25% or more last year. Overall, total consumption of cement in the ten former Soviet Union countries has fallen by almost a quarter. Demand in the region was satisfied mostly by produce from local plants, along with additional supplies from countries such as Turkey and China.

The cement markets in the region have been recovering so far in 2010, and we expect a 6% year-on-year increase in combined consumption for the whole year. This will be followed by an even more substantial increase of 13% in both 2011 and 2012, which will be prompted by more strenuous efforts on the part of governments to support the construction industries in their countries and by the numerous projects carried out as part of the preparation for events to be held in the region, such as the 2014 Sochi Olympics and the 2012 European Football Championship. As a result, combined cement consumption in the region will exceed 100 million tonnes in 2012.

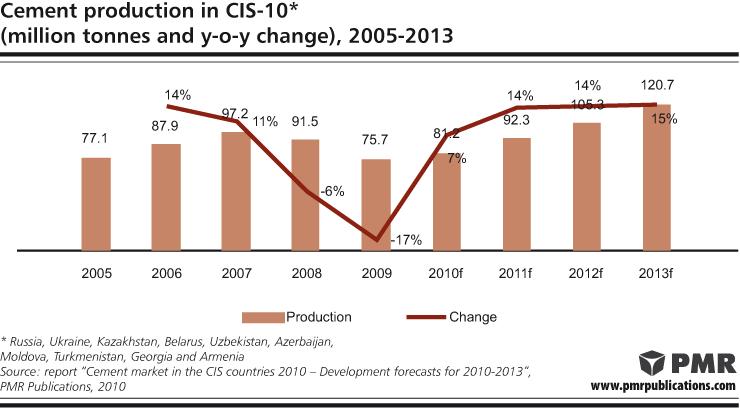

Until 2008, cement production in the ten countries in question grew by more than 10% each year, as cement plants strove to meet growing demand. As a result, output in 2007 exceeded the figure observed four years before by more than 50%. In 2008, however, the 90 cement plants operating in the region reduced production levels to just over 90 million tonnes – with Russia accounting for 60% of total output – in order to adjust to the more modest demand for, and increased imports of, cement to the region. This was followed by a 17% reduction to fewer than 76 million tonnes in 2009, as construction activity declined substantially.

In anticipation of increases in demand in the future, cement producers have – often with government support – embarked upon numerous cement production capacity upgrade projects. By and large, the goal is to replace imports of cement with domestic production, and possibly increase export volumes at the same time. This strategy, applied simultaneously in several countries, could, however, lead to cement overcapacity in the CIS region in the next few years. We expect combined cement production in the ten countries discussed to grow by 7% this year, and growth to double over the next three years.

Growth Returns to Cement Markets in CIS Countries

This press release is based on information included in the latest PMR report entitled “Cement market in CIS countries 2010 – Development forecasts for 2010-2013”.

For more information on the report please contact PMR:

Marketing Department:

tel. /48/ 12 618 90 00

e-mail: [email protected]

Constructionshows

Constructionshows