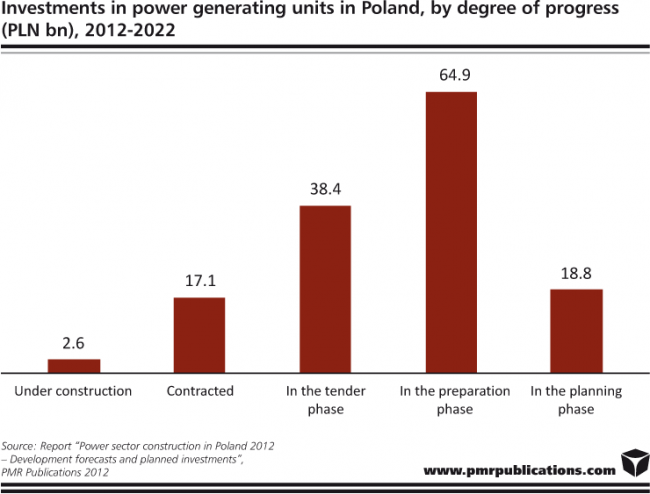

The power engineering segment is currently the only way for the construction industry to overcome the slowdown and a remedy to the falling number of investment projects in the road construction sector. Projects valued at PLN 2.6bn (€600m) are currently underway, while contracts totalling PLN 17bn (€4bn) have been awarded and are about to enter the construction phase soon.

In 2010-2011, the conventional power sector was meticulously preparing power projects and launching tender procedures concerning the implementation of tasks improving efficiency of power plants and CHP plants. The first effects of these efforts can be seen in 2012. According to a report entitled “Power sector construction in Poland 2012 – Development forecasts and planned investments“ prepared by research company PMR, several medium-sized projects with the aggregate capacity of nearly 500 WM and worth almost PLN 2.6bn (€600m) are currently in the construction phase. It should be noted though, that this is just the beginning of the upward trend in the power construction market.

Another group of projects are those where contracts with contractors have been signed and which are about to be launched in the near future. The total value of these projects amounts to PLN 17bn (€4bn), while their aggregate capacity exceeds 3,000 MW, three-quarters of which is represented by the three largest projects. The value of the project involving the construction of a new power generating unit at Rybnik Power Plant is estimated at PLN 5.7bn (€1.3bn), while the development two units at Opole Power Plant will cost PLN 9.4bn (€2.2bn) to complete. These units will use hard coal as fuel. Commissioning dates for these projects are expected to be at the turn of 2017-2018. Another project, a tender concerning the construction of new gas-fired units at Stalowa Wola CHP Plant, is valued at PLN 1.6bn (€380m). An analysis of the value of projects which are about to start soon shows the positive effect they are bound to have on the construction and assembly output value, which started to take a major tumble after road construction projects decelerated.

In the long-term horizon, projects in the power sector will have an even greater effect on the construction industry as a whole. The driving force will be projects which are now in the tender phase. These are 14 investment projects with the estimated value totalling in excess of PLN 38bn (€9bn). The largest project is Polnoc Power Plant planned by Kulczyk Investments whose value is around PLN 12bn (€2.8bn) and a unit at Jaworzno Power Plant to be constructed by Tauron − PLN 5bn (€1.2bn). However, a project which is the closest to implementation is the development of a power unit at Kozienice Power Plant. A contractor for the project has already been selected – it is a consortium set up by Hitachi Power Europe and Poland-based Polimex-Mostostal. As per the submitted bid, the companies put the project’s value at more than PLN 5bn (€1.2bn). The project will run from 2013 to 2016.

The project involving the development of Poland’s first nuclear power plant is in the preparation phase as well. It will cost an astonishing PLN 40bn (€9.4bn) or so to carry out. Preparations for the Polish nuclear power plant started some time ago – studies have been going for several years and the formulation of the legal frame for the project is underway. It was recently reported that another step towards delivering the project was made as – PGE, KGHM, Enea and Tauron signed an agreement on joint execution of the project. However, the key part of the proceedings will be the selection of technology, which will determine the project’s shape. Though expected for a long time, the announcement of the tender procedure has been postponed several times.

Delays in the implementation of planned projects are typical for the power sector, not only for the nuclear segment. The main causes of delays include inadequate experience of investors in preparing so complicated undertakings and staff shortages of teams involved in project preparation, on the side of both investors and prospective contractors, who on numerous occasions requested the contracting parties to extend deadlines for bid submission. Besides, the situation is not helped by the fact that the State Treasury is the main shareholder in the major power companies. Consequently, the order in which projects are implemented or decisions on whether to pursue a given project or not mostly depend on politically-driven decisions. These factors result in power projects being carried out over significantly extended periods of time, but this is not necessarily very bad for the construction industry. “Intensive implementation of too many large power projects could destabilise the construction market as did the rapid growth of funding opportunities for projects in the housing market in 2006-2008 and in the road construction market in 2010-2012. However, not all of the projects which are in the pipeline will enter the construction phase as many of them compete with each other,” says Bartlomiej Sosna, Head Construction Analyst at PMR and the report’s coordinator.

This press release is based on information contained in the latest PMR report entitled “Power sector construction in Poland 2012 – Development forecasts and planned investments”.

Source. PMR News Room

Tags News